【双语阅读】沉闷的科学 Dismal science.

2017-08-14 339阅读

Dismal science

Jun 11th 2009

From The Economist print edition

The Nobel laureate speaks on the crisis in the economy and in economics

THE London School of Economics was once so popular among young American scholars that British students used to joke that LSE stood for “Let’s See Europe”. A distinguished sightseer, Paul Krugman, returned to the LSE on June 8th to give the annual Lionel Robbins memorial lectures. Mr Krugman, who gave the Robbins lectures 21 years ago, tried to answer two big questions in the course of his three talks. Why did economists not foresee calamity? And how will the world economy climb out of recession?

The immediate cause of the crisis, “the mother of all global housing bubbles”, was spotted by many economists. That house prices had risen too far was obvious, even if policymakers had seemed less sure. The surprise was that the bursting of the bubble would be so damaging. “I had no idea it would end so badly,” said Mr Krugman.

One big blind spot was the financial system. The mistake was to think “a bank had to look like something Jimmy Stewart could run”, with rows of tellers taking deposits in a marble-fronted building. In fact a bank is anything that uses short-term borrowing to finance long-term assets that are hard to sell at a push. The shadow banking system was as important to the economy as the ordinary kind, but was far more vulnerable. Its collapse was the modern re-run of the bank failures of the 1930s, said Mr Krugman.

The excess borrowing that did for shadow banks threatens consumers, too. They are scrambling to save more as house prices plunge. Their mortgage debts loom larger because of vanishing inflation. This urge to shore up wealth is self-deating in aggregate, as it curbs spending and incomes. It also renders conventional monetary policy impotent, as the interest rate that prevents too much saving is below zero.

That creates a role for fiscal policy. If zero interest rates cannot get consumers to spend, then governments must spend instead. That remedy comes from economics so the discipline is not without merit. The trouble is, “the analysis we’re using is decades old”. It dates back to Keynes, one of the few economists whose reputation has been burnished by the crisis. (Another is Hyman Minsky, whose main insight was that stability leads to too much debt, and then to collapse.) Most work in macroeconomics in the past 30 years has been useless at best and harmful at worst, said Mr Krugman.

As for the economy, the road back to health will be long and painful. The big lesson from past bubbles is that recovery is export-led, which is not helpful “unless we can find another planet to export to”. Otherwise, recovery will have to wait for savings to be rebuilt, and that will not happen quickly. Higher inflation than bore the crisis might help, he said.

【中文翻译对照】

沉闷的科学

2009年6月11日

摘自《经济学人》杂志

诺贝尔奖得主就经济危机和经济学问题发表演讲

伦敦经济学院曾经在美国青年学者中是如此的受欢迎,以至于英国学生曾笑称其为欧洲的象征。六月八日,令人尊敬的客人——保罗克鲁格曼先生,回到伦敦经济学院为一年一度的莱昂内尔罗宾斯纪念典礼做演将。克鲁格曼先生曾在二十一年前的罗宾斯纪念典礼上发表过演说,在当时的三场演讲中,他试图解说两大问题,即 “为什么经济学家不对灾难进行预测?”和“世界经济如何走出衰退?”

许多经济学家认为,引发危机的的直接原因是“全球房地产泡沫之母”。很明显,住房价格已经涨得太高了,虽然决策者们对此看上去并不是很肯定。令人吃惊的是泡沫的破灭竟然会具有如此破坏性。“我不曾想到它会产生如此糟糕的结果,”克鲁格曼先生说。

金融系统是一个大盲点。人们所犯的错误是认为“银行看上去就像是吉米·史都华(注2)能够掌控一样”,出纳员在大理石建筑中排队领取保证金。(注3)而事实上银行是任何通过短期借款来进行长期融资的机构,很难一下子卖出所有金融品。影子银行体系对于经济来说与普通商业银行体系同样重要,但却脆弱的多。这一体系的崩溃其实是上世纪三十年代中的银行倒闭在现代的重演罢了,克鲁格曼先生说。

影子银行(注4)过度借款也造成了消费恐慌。由于房价的暴跌,消费者们争着将更多的钱放进银行。通货膨胀的消失使他们的抵押债务所面临的形势变得相当严峻。这种强烈的财富保值意识宏观加总后反而弄巧成拙,因为这抑制了支出和收入。它也使得传统的货币政策变得无能为力,因为为了阻止过多的储蓄,利率已经为负了。

这创造了一个财政政策的新作用。如果零利率不能刺激消费,那么政府就必须代为支出。这个补救措施源自经济学研究,因此不是毫无价值的。但问题是“我们所使用的这种经济学分析已经有几十年的历史了”。这可以追溯到凯恩斯,他是为数不多的因危机而成名的经济学家中的一位。(另一位是海曼明斯基,他的主要观点是稳定导致过多债务从而引发崩溃。)宏观经济学在近30年中的多数研究说得好听点是毫无用处的,说的难听点甚至是有害的,克鲁格曼先生如是说。

至于经济,恢复健康的道路将是漫长而又痛苦的。从过去的泡沫危机中得到的启示是由出口带动经济复苏是无益的,“除非我们能找到另一个星球并对其进行出口”。否则,想要经济复苏就不得不等待储蓄的重建,而那不是短时间内能够完成的。比危机发生前更高的通胀也许有帮助,他说。

【注释】

1. 经济学常常被称为“沉闷的科学”,因为经济学家经常带来坏消息。经济学不那么讨人喜欢,认真的经济学家常常带来泼冷水似的意见。他们会指出一个表面上看来很吸引人的项目,很可能结局并不那么美妙。

2. 吉米·史都华:即詹姆斯·史都华(James Stewart),好莱坞影星,主演过《费城故事》、《后窗》、《迷魂记》、《桃色血案》等名片。

3. 关于这句话,我网上查了很多资料,克鲁格曼所指的应该是史都华所演的《风云人物》中的场景,这部片子我现在在下,看过之后应该就可以理解了。

4. 所谓影子银行系统,就是一群非银行机构,但是它们又确实在发挥着一整套银行的功能。比如它们将房地产贷款加工成有价证券,交易到资本市场,房地产业传统上由银行系统承担的融资功能逐渐被投资所替代,属于银行的证券化活动。

【双语阅读】沉闷的科学 Dismal science 中文对照翻译Dismal science

Jun 11th 2009

From The Economist print edition

The Nobel laureate speaks on the crisis in the economy and in economics

THE London School of Economics was once so popular among young American scholars that British students used to joke that LSE stood for “Let’s See Europe”. A distinguished sightseer, Paul Krugman, returned to the LSE on June 8th to give the annual Lionel Robbins memorial lectures. Mr Krugman, who gave the Robbins lectures 21 years ago, tried to answer two big questions in the course of his three talks. Why did economists not foresee calamity? And how will the world economy climb out of recession?

The immediate cause of the crisis, “the mother of all global housing bubbles”, was spotted by many economists. That house prices had risen too far was obvious, even if policymakers had seemed less sure. The surprise was that the bursting of the bubble would be so damaging. “I had no idea it would end so badly,” said Mr Krugman.

One big blind spot was the financial system. The mistake was to think “a bank had to look like something Jimmy Stewart could run”, with rows of tellers taking deposits in a marble-fronted building. In fact a bank is anything that uses short-term borrowing to finance long-term assets that are hard to sell at a push. The shadow banking system was as important to the economy as the ordinary kind, but was far more vulnerable. Its collapse was the modern re-run of the bank failures of the 1930s, said Mr Krugman.

The excess borrowing that did for shadow banks threatens consumers, too. They are scrambling to save more as house prices plunge. Their mortgage debts loom larger because of vanishing inflation. This urge to shore up wealth is self-deating in aggregate, as it curbs spending and incomes. It also renders conventional monetary policy impotent, as the interest rate that prevents too much saving is below zero.

That creates a role for fiscal policy. If zero interest rates cannot get consumers to spend, then governments must spend instead. That remedy comes from economics so the discipline is not without merit. The trouble is, “the analysis we’re using is decades old”. It dates back to Keynes, one of the few economists whose reputation has been burnished by the crisis. (Another is Hyman Minsky, whose main insight was that stability leads to too much debt, and then to collapse.) Most work in macroeconomics in the past 30 years has been useless at best and harmful at worst, said Mr Krugman.

As for the economy, the road back to health will be long and painful. The big lesson from past bubbles is that recovery is export-led, which is not helpful “unless we can find another planet to export to”. Otherwise, recovery will have to wait for savings to be rebuilt, and that will not happen quickly. Higher inflation than bore the crisis might help, he said.

上12下

共2页

阅读全文留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

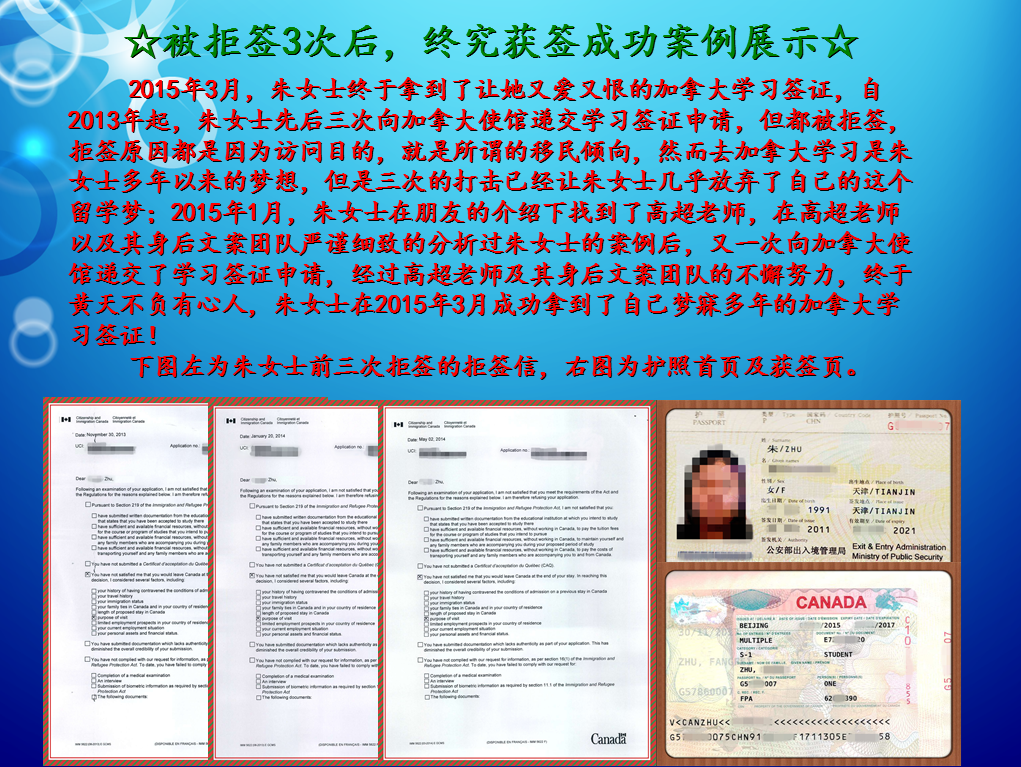

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

高国强 向我咨询

行业年龄 13年

成功案例 3471人

留学关乎到一个家庭的期望以及一个学生的未来,作为一名留学规划导师,我一直坚信最基本且最重要的品质是认真负责的态度。基于对学生和家长认真负责的原则,结合丰富的申请经验,更有效地帮助学生清晰未来发展方向,顺利进入理想院校。

Tara 向我咨询

行业年龄 8年

成功案例 2136人

薛占秋 向我咨询

行业年龄 12年

成功案例 1869人

从业3年来成功协助数百同学拿到英、美、加、澳等各国学习签证,递签成功率90%以上,大大超过同业平均水平。

Cindy 向我咨询

行业年龄 20年

成功案例 5340人

精通各类升学,转学,墨尔本的公立私立初高中,小学,高中升大学的申请流程及入学要求。本科升学研究生,转如入其他学校等服务。