为何美国人不能按理想年龄退休?.

2017-08-14 338阅读

双语阅读是英语学习频道下的的栏目,内容包括双语情感贴士、双语新闻、双语研究、双语健康咨询、双语娱乐明星等英语双语阅读,皆为中英对照双语阅读的生活资讯。

为何美国人不能按理想年龄退休?

The ideal retirement age -- and why you won&apost retire then

Working Americans expect to retire at age 66, up from 63 in 2002, according to a recent Gallup poll. But most retirees don&apost stay on the job nearly that long.

The average retirement age among retirees is 62, Gallup found. And even retirement at age 62 is a recent development. The average retirement age has hovered around 60 for most of the past decade.

"Americans have two reasons in which they may project a later retirement year. One is financial, and they simply think they will need to work longer because there are fewer pensions, and now people may have a more psychologically positive view of work," says Frank Newport, editor-in-chi of Gallup poll. But a plan to work longer isn&apost the same as keeping a job into your mid- or late 60s.

Other surveys have similarly found a significant gap between the age workers anticipate retiring and when they actually leave their jobs. A 2014 Employee Benit Research Institute survey found that 33 percent of workers expect to retire after age 65, but only 16 percent of retirees report staying on the job that long. Just 9 percent of workers say they are planning to retire bore age 60, but 35 percent of retirees say they retired that early. The median retirement age in the survey was 62.

Many of these early retirements are unexpected and due to unforeseen circumstances. About half (49 percent) of retirees say they lt the workforce earlier than planned, often to cope with a health problem or disability (61 percent) or to care for a spouse or other family member (18 percent), EBRI found. Other retirees are forced out of their jobs due to changes at their company, such as a downsizing or closure (18 percent), changes in the skills required for their job (7 percent) or other work-related reasons (22 percent).

"The difference is between what you know you want to do and what factors outside your control ultimately require you to do," says Dallas Salisbury, president of EBRI. "I will tell you I want to continue working on the assumption that I can keep my job or get a new job, and then my job goes away because the plant closes down or something like that. Or I am very healthy when you ask me that question, and then I suddenly get pushed down a flight of stairs and end up disabled and out of work and on permanent disability for the balance of my life. You end up leaving long bore you anticipated."

Of course, there are also some fortunate retirees who are able to retire early because they can afford it (26 percent) or want to do something else (19 percent), perhaps due to an inheritance, unexpected windfall or diligent saving.

An unplanned retirement generally means you need to regroup and make the best of the resources you have. "When you&aposre forced into it, the key thing is to be mentally flexible," says Michael Chadwick, a certified financial planner and CEO of Chadwick Financial Advisors in Unionville, Connecticut. "The trajectory you were on when all was well isn&apost likely to be the same trajectory you&aposre going to achieve with these new circumstances." You&aposll need to look at your severance package and ability to collect unemployment if you are laid off. And if you&aposre under 65 and can&apost sign up for Medicare, you&aposll need to make important decisions about your health insurance.

An emergency fund is likely to be extremely helpful to people who find themselves retiring ahead of schedule. "You can have your ducks in a row by living below your means and saving well, so if something happens, you&aposve got a cushion and are not desperate," Chadwick says. "Try not to live paycheck to paycheck, and only carry good debt, such as mortgage, tuition and low-rate car loans."

While you may want to keep working during the traditional retirement years to finance a better lifestyle, there&aposs a reasonable possibility that you might not get to choose when you retire, and this should be factored into your retirement preparations. "People would be much better off planning as if they will be unable to work in retirement," says Greg Burrows, senior vice president for retirement and investor services at Principal Financial Group, an underwriter of the EBRI survey. "If they get to retirement and can work, then they have that option, and that&aposs a bonus opportunity."

最近一项盖洛普民意调查显示,美国人退休年龄将从2002年的63岁增长至66岁,但大多数临退休人员难以坚守岗位。

调查发现,美国平均退休年龄为62岁——这也是最近的趋势。而过去十年里,平均退休年龄一直在60岁徘徊。

“美国人提倡延迟退休可能出于两层考虑。一是财务问题,由于养老金减少,美国人觉得有必要延长工作年限;其次,现在人们的工作心理更加健康。”弗兰克•纽波特评论道,他是盖洛普民意测验主编。但计划延长工龄并不意味着能工作到古稀之年。

其他调查也有类似发现:工人预计与实际退休年龄之间存在显著差距。2014年雇员福利研究所(EBRI)调查发现,33%的工人表示65岁后才退休,但真正做到的只有16%。只有9%的员工表示计划在60岁前退休,实际上该数据却达到了35%。调查显示平均退休年龄是62岁。

提前退休往往出乎意料,为不可预见的形势所迫。EBRI发现,49%的员工表明,他们比原计划提前退休,主要有以下原因:健康问题或残疾(61%);照顾配偶或其他家庭成员(18%)。其他退休人员被迫离职原因包括:公司发生变动,诸如裁员或倒闭(18%);工作技能要求变化(7%)或其他与工作有关的因素(22%)。

“理想与现实终究是有差距的,人为无法控制的外因能影响我们最终的决定。”EBRI总裁达拉斯•萨利斯伯瑞(Dallas Salisbury)说。 “假设我能够保住现有饭碗或找到新工作,我会告诉你我想要继续努力奋斗下去,但突然有一天工厂倒闭我成了无业游民。或者接受调查时我很健康,但突然某一天我从楼梯上摔下来,残疾的同时也失去了工作和生活的平衡。结果你离职比自己预想的早得多。”

当然,也有一些人幸运继承、意外发财或勤于储蓄,他们提前退休一是具备负担能力(26%),或是想做些别的事情(19%)。

意外退休通常意味着需要重新组合、充分利用现有资源。“被迫退休时,思想灵活十分关键。”认证理财规划师迈克尔•查德威克表示,他同时也是康涅狄格州尤宁维尔查德威克财务顾问公司总裁。他还说,“先前的轨迹与你今后的发展轨迹不一定一致,因为形势在变化。”如果不幸下岗,你就得仰仗遣散费和失业金。假如你低于65岁没有医保,你就得考虑健康保险。

紧急基金能够帮助那些提前退休者。“适度节俭储蓄得当,生活就会井井有条。即便发生了什么事,也能得到缓冲不致绝望,”查德威克说,“尽量不做月光族,只贷良性债务——如抵押贷款,上学贷款和低利率汽车贷款。”

尽管你可能想继续工作到惯常退休年龄,然后有足够资金安享晚年,但极有可能退休由不得你。你在做退休准备时也应该考虑到这种可能性。“人们应当做好不能工作到退休的规划,这样晚年就不用愁经济状况,”信安金融集团(EBRI调查包销商)退休及投资者服务中心高级副总裁Greg Burrows表示,“如果人们临近退休仍能正常工作,就有机会获得额外报酬。”

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

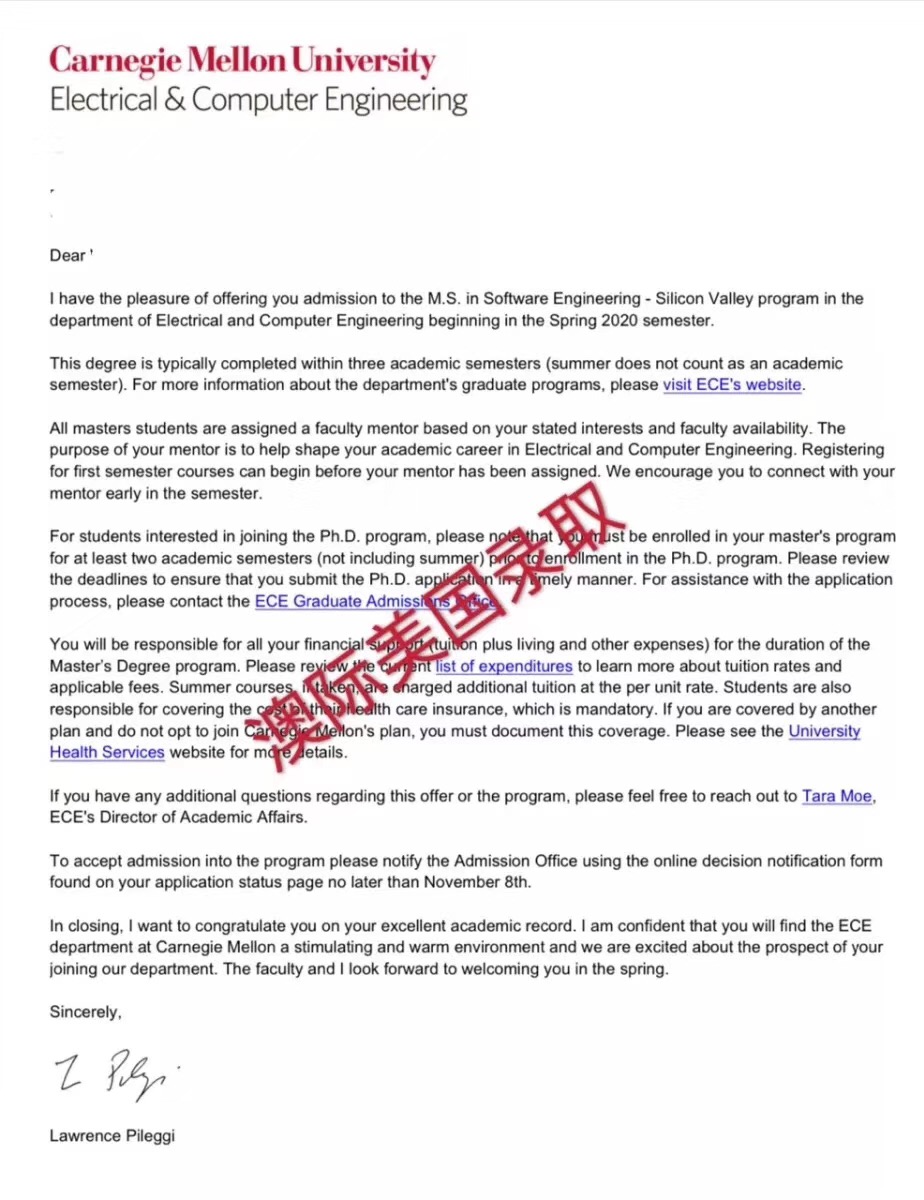

高国强 向我咨询

行业年龄 13年

成功案例 3471人

留学关乎到一个家庭的期望以及一个学生的未来,作为一名留学规划导师,我一直坚信最基本且最重要的品质是认真负责的态度。基于对学生和家长认真负责的原则,结合丰富的申请经验,更有效地帮助学生清晰未来发展方向,顺利进入理想院校。

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

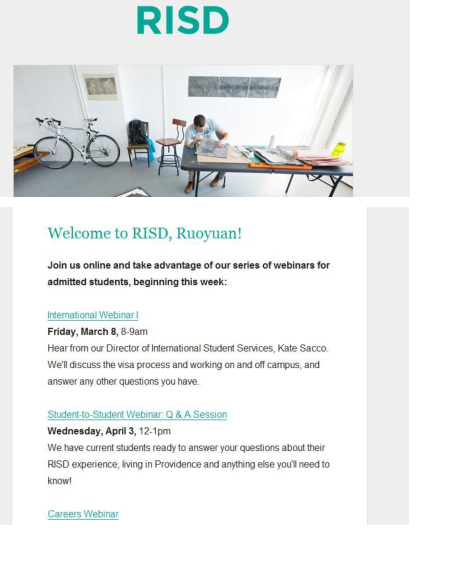

齐亚楠 向我咨询

行业年龄 15年

成功案例 4070人

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

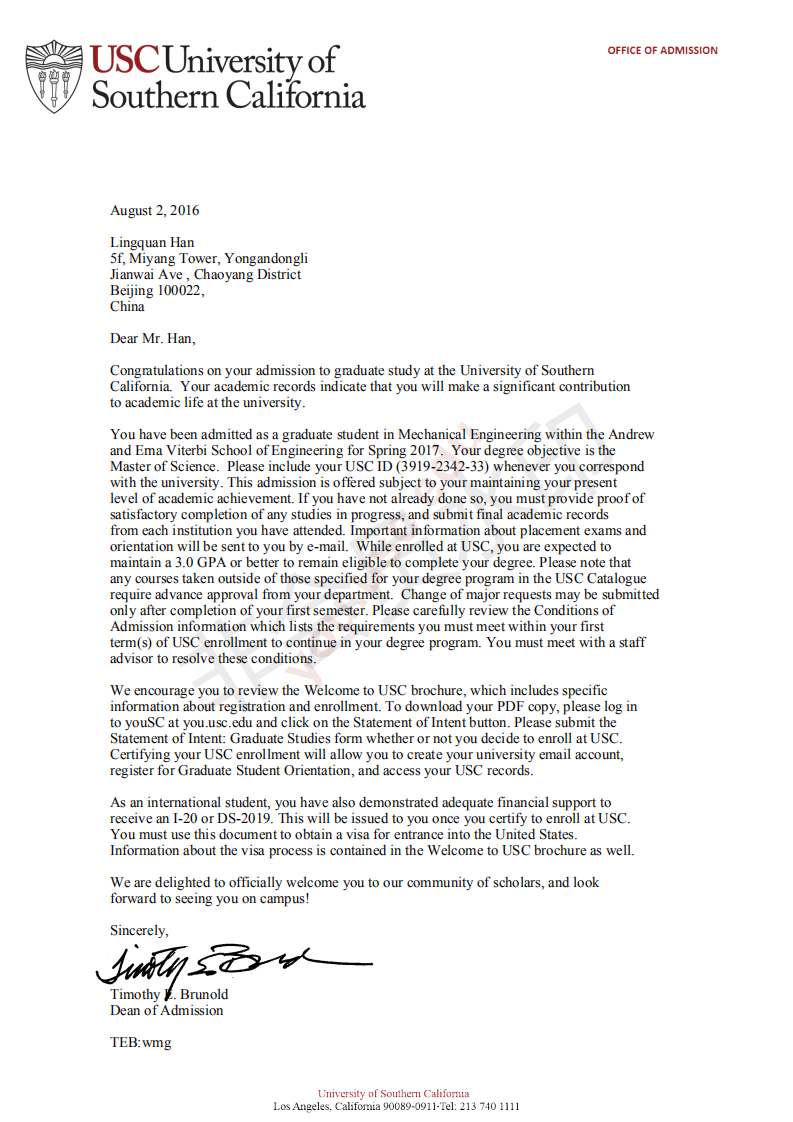

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。