央行“品牌”受威胁.

2017-08-13 267阅读

现代央行“品牌”开始于80年代早期的美国,沃尔克(Paul Volcker)担任美联储(Fed)主席的时候。面临高通胀势头,沃尔克对其宣战——并获得胜利。为了提供长期反通胀情境,他不止改变了预期和经济行为。他也极大地增强了美联储在公众、金融市场和决策圈中的地位。

The “branding” of modern central banking started in the United States in the early 1980’s under then-Federal Reserve Board Chairman Paul Volcker. Facing worrisomely high and debilitating inflation, Volcker declared war against it – and won. In delivering secular disinflation, he did more than change expectations and economic behavior. He also greatly enhanced the Fed’s standing among the general public, in financial markets, and in policy circles.沃尔克的胜利通过立法和实践制度化,使央行获得了更大的自治权,在某些情况下,不受长期政治约束的限制。对许多人来说,央行现在代表可靠性和负责任。简单地说,人们相信央行将做正确的事;他们也这样做了。

Volcker’s victory was institutionalized in legislation and practices that granted central banks greater autonomy and, in some cases, formal independence from long-standing political constraints. To many, central banks now stood for reliability and responsible power. Simply put, they could be trusted to do the right thing; and they delivered.任何企业高管都会告诉你,品牌将间接驱动行为。本质上,品牌是一个承诺;强大的品牌持续履行承诺——基于质量、价格、或经验。在某些情况下,消费者会受到品牌的影响,甚至购买采购不大了解的产品。

As any corporate executive will tell you, brands can be consequential drivers of behavior. In essence, a brand is a promise; and powerful brands deliver on their promise consistently – be it based on quality, price, or experience. In some cases, consumers have been known to act on the strength of brand alone, even purchasing a product with relatively limited knowledge about it.事实上,品牌发送出的信号便于手头任务的完成。在一些特殊的情况下——想想苹果公司、伯克希尔?哈撒韦公司、Facebook和谷歌——他们充当了重要的行为变动催化剂。在这个过程中,他们经常从本质上将定价和基本面区分开来。

Indeed, brands send signals that facilitate the task at hand. In some special cases – think of Apple, Berkshire Hathaway, Facebook, and Google – they have also acted as a significant catalyst for behavioral modification. In the process, they often insert a wedge that essentially disconnects fundamentals from pricing.基于沃尔克的成功,西方央行使用其品牌来维持低而稳定的通货膨胀。通过发出遏制价格压力的信号,他们改变通胀预期——从基本上说服公众和政府来承担这个重任。

Building on Volcker’s success, Western central banks have used their brand to help maintain low and stable inflation. By signaling their intention to contain price pressures, they would alter inflation expectations – and thus essentially convince the public and the government to do the heavy lifting.然而,在过去的几年里,通货膨胀威胁已不是问题。相反,西方央行不得不面对市场失灵,金融体系支离破碎,货币政策传导机制堵塞以及产出和就业的缓慢增长。由于在实现预期结果方面面临着更大的挑战,他们基本上把政策和品牌力量推向极限。

In the last few years, however, the threat of inflation has not been an issue. Instead, Western central banks have had to confront market failures, fragmented financial systems, clogged monetary-policy transmission mechanisms, and sluggish growth in output and employment. Facing greater challenges in delivering desired outcomes, they have essentially pushed both policies and their brand power to the limit.这在央行积极强调沟通和政策指导方面表现得尤为明显。这两方面都被更广泛的使用——事实上,已达到极端的水平——以在流动性陷阱的背景下辅助非常规扩张的资产负债表。

This is apparent in central banks’ aggressive emphasis on communication and forward policy guidance. Both have been used more widely – indeed, taken to extreme levels – to supplement the unconventional expansion of balance sheets in the context of liquidity traps.

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

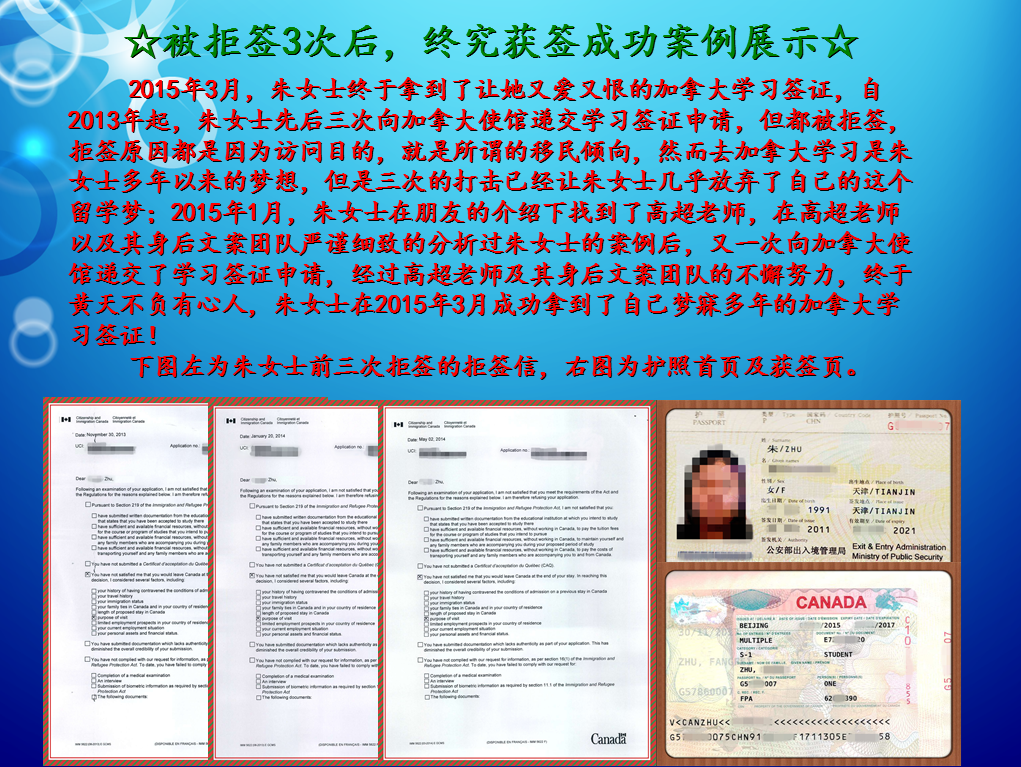

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

高国强 向我咨询

行业年龄 11年

成功案例 2937人

留学关乎到一个家庭的期望以及一个学生的未来,作为一名留学规划导师,我一直坚信最基本且最重要的品质是认真负责的态度。基于对学生和家长认真负责的原则,结合丰富的申请经验,更有效地帮助学生清晰未来发展方向,顺利进入理想院校。

Tara 向我咨询

行业年龄 6年

成功案例 1602人

薛占秋 向我咨询

行业年龄 10年

成功案例 1869人

从业3年来成功协助数百同学拿到英、美、加、澳等各国学习签证,递签成功率90%以上,大大超过同业平均水平。

Cindy 向我咨询

行业年龄 18年

成功案例 4806人

精通各类升学,转学,墨尔本的公立私立初高中,小学,高中升大学的申请流程及入学要求。本科升学研究生,转如入其他学校等服务。