七个财务稳定的人的习惯.

2017-08-13 389阅读

Keeping your financial life stable requires some discipline and development of good financial habits. We all do not want to be in a financial hole that leaves us emotionally and psychologically devastated. It is better to protect our finances when we can, bore situations cause our money to slip away from our fingers. That is why it is important to learn a thing or two from the financially stable.

保持你的财务生活稳定需要严格的纪律和一些良好的发展理财习惯。我们都不希望有金融洞让我们的情感和心理上摧毁。最好是在我们的钱从我们的手指悄悄溜走的情况之前保护我们的财务状况。这就是为什么重要的是要学到一二件使财务状况稳定的事。

1. They don’t spend impulsively

他们不冲动花钱

Money has a way of engaging us. This apparently happens to a big problem for us all as we want to take advantage of the “easier” life. Impulse spending means eating out and shopping extensively until we drain our finances. Financial stability can only be attained when we control and monitor our impulse spending.

钱是吸引我们的一种方式。这显然为我们所有想利用“容易”生活的人产生一个大问题。冲动消费意味着经常外出吃饭和购物,直到我们财政流失。只有我们控制和监视我们的冲动消费金融才会稳定。

2. They save money

他们节省钱

Financially stable people spend less than they earn. You may not have abundant capital but you can indulge in the right and important things and not overspend. This affords you the opportunity to save money. So learn to negotiate phone, cable and utility bills. Or simply reduce how much you spend on grocery, restaurants and clothing.

财务状况稳定人花得比赚的少。你可能没有充裕的资本但你可以沉溺于正确的和重要的事情,不超支。这给你省钱的机会。所以学会谈判电话,有线电视和水电费。或者只是减少你在杂货店,餐馆和衣服上花的钱。

3. They track their spending

他们追踪他们的开支

They monitor their spending. This can be done occasionally. Perhaps once a month you can write how much you have spent, and see what areas you are running dicient. When this is done one can understand how ficient he is using up his finances.

他们监视他们的支出。偶尔可以做到这一点。也许一个月一次你可以写你花了多少钱,看看哪些方面您正在运行缺陷。当这样做是一次能知道他是多么有效使用财政。

4. They invest

他们投资

Financial stable people do well to secure their future. Even when retirement isn’t lurking nearby you can start setting some money outside in deposits for investments

金融稳定的人们能好好保护他们的未来。即使退休不是最近潜在的,你也可以在存款中设置一些钱进行投资

5. They eliminate and prevent debts

他们消除和防止债务

All debts are not the same. A loan that builds with high interest is not the same as low interest loans such as mortgage and student loans. Debt has a psychological fect that works against the debtor, so it is better to eliminate or prevent debts. Know how much you owe now, whether it is a car loan or credit card debt.

所有债务都是不一样的。高利息贷款,低利率贷款抵押贷款和学生贷款等是不一样的。债务不利于债务人的心理效应,所以最好是消除或防止债务。现在知道你欠多少,知道这是否是汽车贷款或信用卡债务。

6. They budget

他们做预算

Financially stable people budget their income. By using a budget they are able to ascertain where their money is going to and seeing that it goes to where they actually want it to go to. With apps like Mint and You need a budget you can take charge of your budget and start becoming accountable for it.

财政稳定的人会预算收入。通过做预算他们能够确定他们的钱都花到哪里去了,看看它实际上有没花到他们想要花的地方。与薄荷等应用程序,你需要一个可以负责你的预算和预算开始为它负责。

7. They respond automatically

他们自动回复

Yes they do not procrastinate with their finance. They do not delay in the paying of their bills. By doing this there is no room for debt growth and affords you the opportunity to know what money can be used for personal expenses.

是的,他们不拖延财务。他们不推迟支付他们的账单。这样做没有债务增长的空间,使你有机会知道钱可以用于个人费用。

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

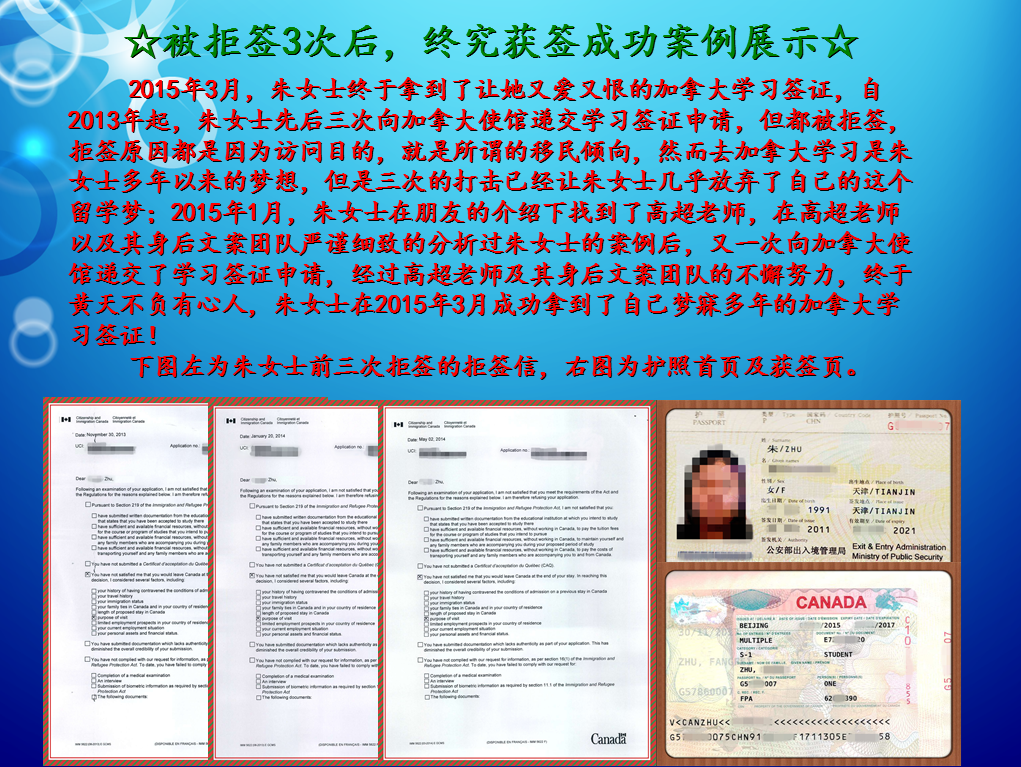

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

Tara 向我咨询

行业年龄 8年

成功案例 2136人

Cindy 向我咨询

行业年龄 20年

成功案例 5340人

精通各类升学,转学,墨尔本的公立私立初高中,小学,高中升大学的申请流程及入学要求。本科升学研究生,转如入其他学校等服务。

薛占秋 向我咨询

行业年龄 12年

成功案例 1869人

从业3年来成功协助数百同学拿到英、美、加、澳等各国学习签证,递签成功率90%以上,大大超过同业平均水平。

Amy GUO 向我咨询

行业年龄 18年

成功案例 4806人

熟悉澳洲教育体系,精通各类学校申请程序和移民局条例,擅长低龄中学公立私立学校,预科,本科,研究生申请