经济类雅思阅读:Banks exposures for all to see

2017-07-10 263阅读

不断的练习是提升雅思阅读水平的一大常见方法,同学们在备考阶段应找到难度恰当的阅读理解进行练习。希望以下内容能够对大家的雅思学习有所帮助!

THERE are worrying similarities between 2008 and today as indicators point to another interbank lending freeze. But there also some important differences: credit bubbles are dlated, housing prices adjusted, private debt reduced and, last but not least, banks have started to deleverage their balance sheets, mainly by strengthening their capital and reserves; even in Europe, banks have increased their capital by more than 20% on average since Lehman.

However, the decisive difference is with regard to the distribution and probability of expected losses, resulting in 2008 mainly from housing loans but today from government debt.

In 2008, losses resulting from the subprime and securitisation debacle were a done deal; there was (and still is) no quick remedy to revive the housing market. But what was unclear was the exposure of each bank to these toxic assets, especially as exposure came not in plain vanilla but in wrapped and structured style. Governments’ task was to make sure that banks could withstand the losses that were bound to hit the banks. Not knowing which banks were most exposed, they offered a wide range of public support to all of them.

Today, the exposure of each bank to government debt is there for all to see, thanks to the last round of the European banking stress tests. But writedowns on these assets are far from clear (except in the case of Greek bonds); it depends entirely on the actions of policymakers. It is in their hands to avoid dault.

A "prepare for the worst approach", i.e. a preventive recapitalisation of all banks as in 2008, therore seems less convincing. For two reasons: firstly, it is rather bizarre that governments should use public money to recapitalise banks, forcing them to build a capital buffer against public dault—an event that only becomes more likely if governments have to channel so much money into banks to protect them against it. Sounds rather absurd.

Secondly, a dault of, say, Italy would be financial Armageddon. Bolstering capital buffers to hold out against such a shockwave would be like re-arranging the deckchairs on the Titanic. There is no reasonable amount of capital that could protect banks against it.

Simply more capital is not the solution. This is also evidenced by the woes of Dexia—which would pass even the toughest stress test (thanks to a high capital ratio) but is nonetheless a failed bank because its business model lacks a stable funding base. The lesson is clear: as long as investors fear further writedowns on government debt, a high capital ratio will not dispel such mistrust.

It is more convincing to tackle the root of the problem. The EFSF should be put to better use than tossing more money at the banks. Governments should instead eliminate the risk that such a need could ever arise. In other words, they have to quash the probability of sovereign dault in the euro zone, neutralise the "Greek factor" and make sure that all other countries—which face liquidity problems but are not insolvent—will honour their debt. Besides meaningful consolidation and rorm forts, that requires an ficient crisis management mechanism to stop contagion. In that respect, the most promising idea is to allow the EFSF, and then its permanent successor the ESM, to function as a bond insurer. Only then, will investors’ distrust towards banks be lifted.

The bottom line: after Lehman, governments around the world did a terrific job in supporting banks, leading to an astonishingly quick recovery of the banking world (also in terms of profits and bonuses). This time around, the infective forts to resolve the euro crisis let the banks down. Now, they have to bear the brunt. But a larger scale banking crisis can still be avoided. All that is required? Decisive action by policymakers to finally curb the sovereign debt crisis.

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

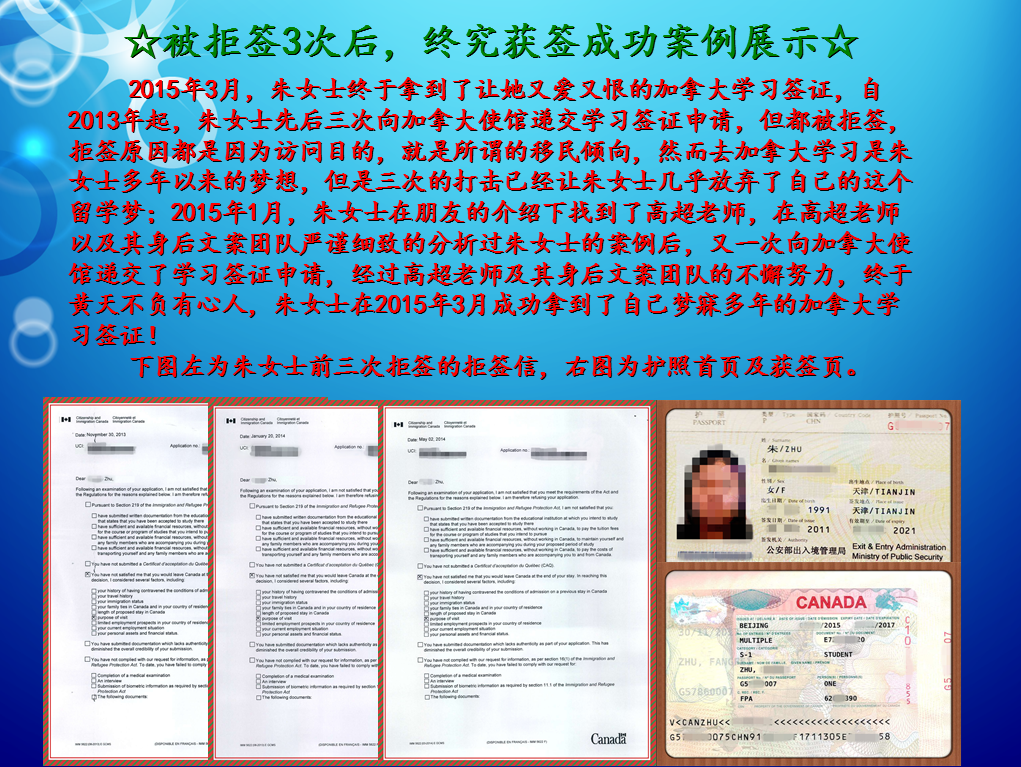

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

Tara 向我咨询

行业年龄 8年

成功案例 2136人

Cindy 向我咨询

行业年龄 20年

成功案例 5340人

精通各类升学,转学,墨尔本的公立私立初高中,小学,高中升大学的申请流程及入学要求。本科升学研究生,转如入其他学校等服务。

薛占秋 向我咨询

行业年龄 12年

成功案例 1869人

从业3年来成功协助数百同学拿到英、美、加、澳等各国学习签证,递签成功率90%以上,大大超过同业平均水平。

Amy GUO 向我咨询

行业年龄 18年

成功案例 4806人

熟悉澳洲教育体系,精通各类学校申请程序和移民局条例,擅长低龄中学公立私立学校,预科,本科,研究生申请