【双语阅读】美国快捷药方公司与美可保健.

2017-08-14 320阅读

简介:花了八个多月的时间,会面达到200多次。 但是4月2日,美国联邦贸易委员会以三比一的投票决定同意美国快捷药方公司收购美可保健。 两家公司合并后将成为美国第二大药品公司以及最大的药品福利管理者。 这两家公司的合并可能最终改变美国人购买药物的方式。

Business

Express Scripts and Medco

Bigger means cheaper

A new drugs manager may change the way Americans pop their pills

IT TOOK eight months and more than 200 interviews. But on April 2nd America&aposs Federal Trade Commission (FTC) decided, in a three-to-one vote, to let Express Scripts acquire Medco. The two firms are America&aposs second-biggest and biggest pharmacy-benit managers. Eventually, they may change the way Americans take drugs.

Despite an intolerably dull title, pharmacy-benit managers (PBMs) are important. America is the world&aposs biggest drug market; in 2010 it spent more than $307 billion on prescription medicines. PBMs are the middlemen that manage drug costs for employers and insurers. Together, Express Scripts and Medco will control more than 40% of the market.

Express Scripts announced the acquisition in July 2011. Medco was a good company that had had a bad year, and so looked cheap. It had lost about 30% of its business in a few months as some of its largest clients ended their contracts. For both firms, bigger ought to mean better. With scale would come the power to negotiate fatter discounts on drugs, lowering costs for employers and insurers.

Pharmacists felt sick when they heard the news. PBMs encourage consumers to fill their prescriptions through the mail instead of going to a costly pharmacy. PBMs, pharmacists fret, will crush their fees for dispensing drugs. Worse, PBMs will demand that drugmakers give them exclusive deals for new, complex medicines. Competitors and consumers will suffer, the pharmacists argue.

The FTC disagreed. The merged firm is unlikely to squeeze pharmacies&apos fees for dispensing drugs, it ruled. There remain plenty of lively, smaller PBMs. John Kreger of William Blair, an investment bank, says there is enough turmoil—thanks both to the merger and to Express Scripts&apos continuing fight with Walgreens, a big pharmacy—that smaller PBMs may snatch new business in the next year. The small fry may also benit if the pharmacy lobby&aposs lawsuit against the merger moves forward.

The combined firm will have $91 billion in revenue in 2012, estimates Lawrence Marsh, an analyst at Barclays Capital. It is so big that it could shape a new era for America&aposs drug market. As more drugs lose their patents, consumers will increasingly fill their prescriptions with generics. If Express Scripts has its way, they will also fill their prescriptions by post. Medco recently acquired a firm that compares the ficacy of different drugs. This may prove usul when America begins to see cheap copies of complex drugs, called biosimilars, which will be tested against the originals. The new Express Scripts may also play a role on Barack Obama&aposs new insurance exchanges, working with insurers to court individuals shopping for health care.

Most intriguingly, the new Express Scripts could push Americans to buy the right medicines and take them at the right time. For years PBMs have tested ways to urge consumers to buy cheaper, fective drugs. For example, if a patient wants a branded pill rather than a generic, he must pay for more of it himself. Experiments will probably scale up and become more sophisticated. Eventually, they might even spread to Medicaid, the public programme for the poor. Health rorm (unless the Supreme Court strikes it down) will add 16m new members to Medicaid by 2019, a 27% jump. PBMs such as Medco and Express Scripts have so far spent little time chasing the Medicaid market. That may change.

【中文对照翻译】

商业

美国快捷药方公司与美可保健

越大越便宜

全新的药物管理者可能改变美国人购买药品的方式

花了八个多月的时间,会面达到200多次。 但是4月2日,美国联邦贸易委员会以三比一的投票决定同意美国快捷药方公司收购美可保健。 两家公司合并后将成为美国第二大药品公司以及最大的药品福利管理者。 这两家公司的合并可能最终改变美国人购买药物的方式。

尽管标题无聊的令人无法忍受,但是药品福利管理者(PBMs)十分重要。 美国是世界上最大的药品市场;2010年美国在处方药上的花费达到3070亿美元。 药品福利管理是是平衡雇主和保险公司之间医药费用的中间人, 快捷药方公司与美可保健一起将能控制40%以上的药品市场份额。

快捷药方公司曾宣布在2011年7月完成收购工作, 美可保健去年情况不佳,看起来有点贬值,但美可保健是一个业绩不错的公司。 由于一些大客户终止了合同,美可保健几个月内就损失了30%的生意。 对两家公司来说,扩大经营必须意味着良好的收益。 大规模将在药品折扣问题的商讨上占有更大的优势,并降低雇佣者和保险公司的成本。

听说了这个消息之后药剂师感觉并不好。 药品福利管理者鼓励消费者通过邮件方式而不是通过花费过高的药品公司购买药物。 药品福利管理者让药剂师们很头痛,药品福利管理者会把削减开处方药的费用。 更糟糕的是,药品福利管理者要求药品制造上对于新药和合成药给与特别的折扣。 药剂师认为竞争者和消费者都会遭受损失。

联邦贸易委员会并不这么认为。 合并后的公司不可能压榨药剂师配置药物的费用,只是对此收费进行规范。 市场中还有很多小规模活跃的药品福利管理者。 投资银行William Blair的John Kreger说已经够乱了——多亏两家公司的合并,还有快捷药方公司与大型的医药公司Walgreens不断的竞争——小规模的药品福利管理者明年会抢走新业务。 如果反对合并进程的药品游说诉讼能够成功的话,小公司也能从中获益。

据巴莱克集团的分析师Lawrence Marsh预测,合并后的公司在2012年的收益能够达到910亿美元。 收益如此巨大以至于可以塑造美国药品市场的新纪元。 由于越来越多的药品不再拥有专利权,越来越多的消费者都会使用非专利药物开具处方。 如果快捷药品公司也采用此方法,那么他们也会采取邮寄方式开药方。 美可保健最近收购了一家比较药品不同功效的公司。 美国开始看到合成药剂的复制品,即生物仿制药,价格低廉,能用来与源药品做对比试验。此时上述收购还是极为有益的。 新的快捷药方公司同样在奥巴马提出的新型保险交易中扮演了重要角色,他和保险代理人一起劝说个人购买健康保险。

最有趣的是新的快捷药方公司可以推动美国人在正确的时间购买正确的药物。 几年来,药品福利管理者尝试新的方法以促使消费者购买便宜而有效的药物, 例如如果病人想购买品牌药物而非一般药物,他要为多出的费用自己掏腰包。 这样的试验将逐步扩大规模,也会越来越复杂。 最终将波及医疗补助计划,该计划是救助穷人的公共计划。 到2019年,健康改革(除非最高法院将其驳回)将增加160万名新的受益者,约增长了27%。 像美可保健和快捷药方公司这样的药品福利管理者迄今为止在医疗补助计划投入的时间还不多。 这种情况可能会有所改变。

【双语阅读】美国快捷药方公司与美可保健 中文翻译部分简介:花了八个多月的时间,会面达到200多次。 但是4月2日,美国联邦贸易委员会以三比一的投票决定同意美国快捷药方公司收购美可保健。 两家公司合并后将成为美国第二大药品公司以及最大的药品福利管理者。 这两家公司的合并可能最终改变美国人购买药物的方式。

Business

Express Scripts and Medco

Bigger means cheaper

A new drugs manager may change the way Americans pop their pills

IT TOOK eight months and more than 200 interviews. But on April 2nd America&aposs Federal Trade Commission (FTC) decided, in a three-to-one vote, to let Express Scripts acquire Medco. The two firms are America&aposs second-biggest and biggest pharmacy-benit managers. Eventually, they may change the way Americans take drugs.

Despite an intolerably dull title, pharmacy-benit managers (PBMs) are important. America is the world&aposs biggest drug market; in 2010 it spent more than $307 billion on prescription medicines. PBMs are the middlemen that manage drug costs for employers and insurers. Together, Express Scripts and Medco will control more than 40% of the market.

Express Scripts announced the acquisition in July 2011. Medco was a good company that had had a bad year, and so looked cheap. It had lost about 30% of its business in a few months as some of its largest clients ended their contracts. For both firms, bigger ought to mean better. With scale would come the power to negotiate fatter discounts on drugs, lowering costs for employers and insurers.

Pharmacists felt sick when they heard the news. PBMs encourage consumers to fill their prescriptions through the mail instead of going to a costly pharmacy. PBMs, pharmacists fret, will crush their fees for dispensing drugs. Worse, PBMs will demand that drugmakers give them exclusive deals for new, complex medicines. Competitors and consumers will suffer, the pharmacists argue.

The FTC disagreed. The merged firm is unlikely to squeeze pharmacies&apos fees for dispensing drugs, it ruled. There remain plenty of lively, smaller PBMs. John Kreger of William Blair, an investment bank, says there is enough turmoil—thanks both to the merger and to Express Scripts&apos continuing fight with Walgreens, a big pharmacy—that smaller PBMs may snatch new business in the next year. The small fry may also benit if the pharmacy lobby&aposs lawsuit against the merger moves forward.

The combined firm will have $91 billion in revenue in 2012, estimates Lawrence Marsh, an analyst at Barclays Capital. It is so big that it could shape a new era for America&aposs drug market. As more drugs lose their patents, consumers will increasingly fill their prescriptions with generics. If Express Scripts has its way, they will also fill their prescriptions by post. Medco recently acquired a firm that compares the ficacy of different drugs. This may prove usul when America begins to see cheap copies of complex drugs, called biosimilars, which will be tested against the originals. The new Express Scripts may also play a role on Barack Obama&aposs new insurance exchanges, working with insurers to court individuals shopping for health care.

Most intriguingly, the new Express Scripts could push Americans to buy the right medicines and take them at the right time. For years PBMs have tested ways to urge consumers to buy cheaper, fective drugs. For example, if a patient wants a branded pill rather than a generic, he must pay for more of it himself. Experiments will probably scale up and become more sophisticated. Eventually, they might even spread to Medicaid, the public programme for the poor. Health rorm (unless the Supreme Court strikes it down) will add 16m new members to Medicaid by 2019, a 27% jump. PBMs such as Medco and Express Scripts have so far spent little time chasing the Medicaid market. That may change.

上12下

共2页

阅读全文留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

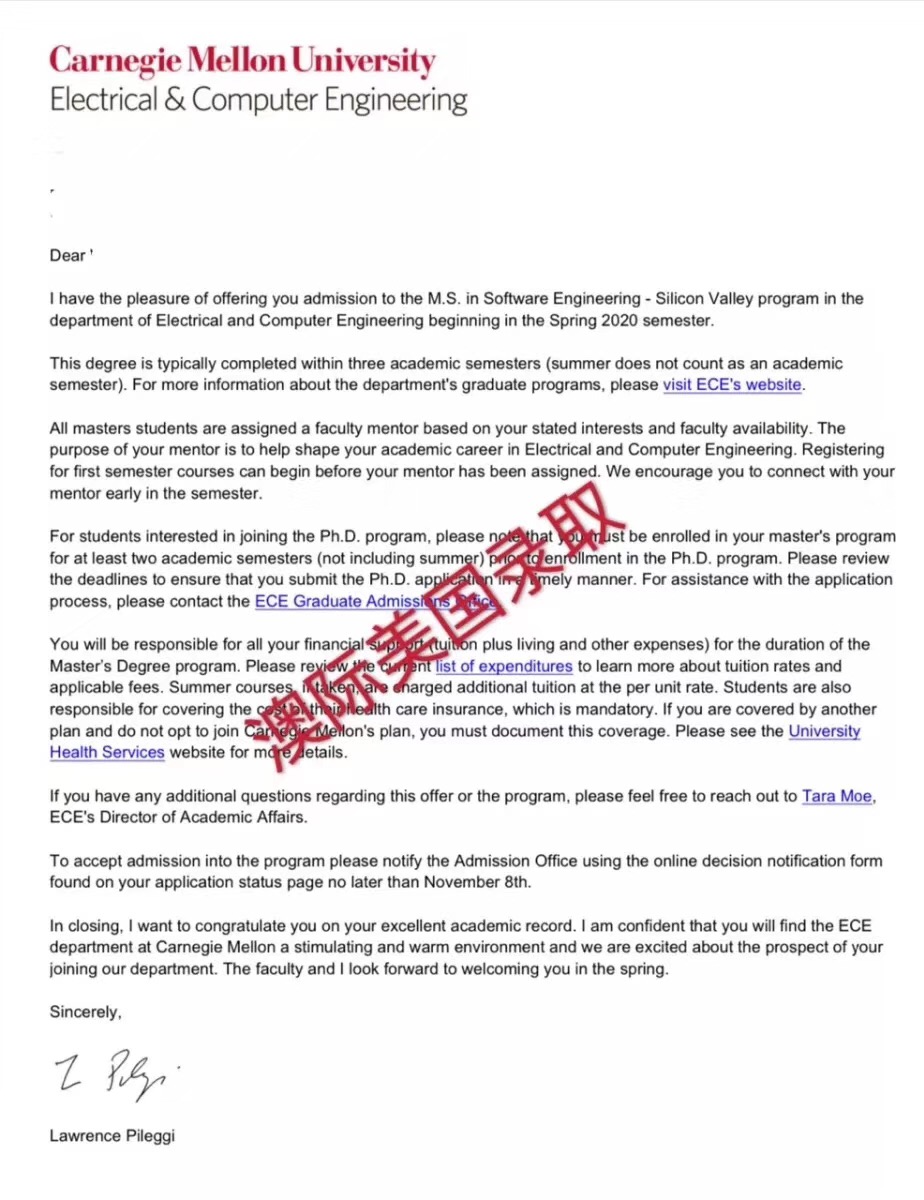

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

齐亚楠 向我咨询

行业年龄 15年

成功案例 4070人

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。

闫丽 向我咨询

行业年龄 19年

成功案例 6995人

成功办理了2000多名学生,申请到斯坦福大学、约翰霍普金斯、康奈尔等世界前30的名校。