美国为什么对借钱的人这么狠?.

2017-08-14 407阅读

双语阅读是英语学习频道下的的栏目,内容包括双语情感贴士、双语新闻、双语研究、双语健康咨询、双语娱乐明星等英语双语阅读,皆为中英对照双语阅读的生活资讯。

Why is the federal government so hard on debtors?

美国为什么对借钱的人这么狠?

Chances are that if you&aposre a debtor, you owe some of that debt to the federal government.

如果你是美国的一名债务人,你有一部分债务的债主可能就是美国联邦政府。

Two major changes to federal policy following the financial crisis -- ousting private banks from the provision of federally backed student loans and the takeover of Fannie Mae and Freddie Mac -- mean that the Feds now own or guarantee several trillions of dollars in mortgage loans and student loan debt.

金融危机之后,美国联邦政策的两个主要变化分别是,禁止私人银行提供联邦支持的助学贷款,以及接管房利美(Fannie Mae)和房地美(Freddie Mac),这意味着美国联邦政府拥有数万亿美元的抵押贷款和助学贷款债务。

This puts the federal government in a great position to eliminate one of the biggest obstacles to the economic recovery, namely the indebtedness of consumers. Online real estate database company Zillow released numbers Tuesday, estimating that nearly 10 million Americans -- or 18.8% of those with home loans -- still owe more on their mortgages than their real estate is worth. Furthermore, Zillow estimates that, nationwide, one-third of Americans who own homes in the bottom third of home values have underwater mortgages (the balance of the mortgage is greater than the market value of the home).

这一点使美国政府在消除经济复苏最大的障碍之一、也就是消费者的债务时,处在了有利地位。在线房地产数据库公司Zillow上周二公布了一组数据,数据显示,约有1,000万美国人或美国住房贷款的18.8%,所欠的抵押贷款超过了房地产的价值。此外,据Zillow估计,房屋价值在后三分之一的美国房主,有三分之一面临的是资不抵债型的房贷(抵押贷款的余额超过了房屋的市场价值)。

These are the kind of homes that first-time homebuyers tend to seek out, and they are being held off the market because their current owners are unable to offload the mortgages associated with them. Zillow&aposs Chi Economist Stan Humphries told CNBC that he believes this is partly why the inventory of homes on the market is so low, a dynamic that has held back the real estate recovery in recent months.

首次购房者往往中意这类房屋,但它们却无法上市,因为它们目前的所有人无法剥离与其相关的抵押贷款。Zillow首席经济师斯坦•汉弗莱斯告诉美国全国广播公司消费者新闻与财经频道(CNBC),他相信这正是市场上房屋库存量低的原因,而低库存在近几个月延缓了房地产市场的复苏。

The fastest growing segment of consumer debt, however, is student loans. And the federal government dominates the student loan business, as it owns hundreds of millions of dollars in student loan debt.

但在消费者债务中,增长最快的是助学贷款。在助学贷款领域,联邦政府占主导地位,持有数以亿计的助学贷款债务。

Economists are in near-unanimous agreement that too much consumer debt isn&apost good for the economy. That&aposs one of most important lessons of economists Ken Rogoff and Carmen Reinhardt&aposs recent work on the fects of financial crises: That following such events, countries tend to grow slowly in part because of the existence of too much debt in the system. As Adam Hersch, senior economist at the Center for American Progress, wrote last month:

经济学家们几乎一致认为,过多的消费者负债对经济不利。这是经济学家肯•罗戈夫和卡门•莱因哈特研究金融危机的影响得出的最重要的教训之一:金融危机之后,国家增长放缓,一定程度上是由于系统中存在太多的债务。正如美国进步中心(Center for American Progress)高级经济师亚当•赫尔施在上个月所写的那样:

Compared to the prior three U.S. expansions, going back to 1982, the economy is recovering at merely 60% of that pace. Whereas at this point in past recoveries, the economy expanded by an average of 19%, today, the U.S. economy has grown just 11% overall since the economy&aposs June 2009 trough.

美国从1982年开始经历了三次经济扩张,而此次美国经济复苏的速度仅有之前的60%。在过往经济复苏的这个点,经济平均按照19%的速度扩张,但自2009年6月的经济低谷以来,美国经济仅增长了11%。

The first key difference is what caused this economic mess in the first place, namely, the depth of the real estate collapse and the wicked hangover of debts lt in its wake. The burden of these debts on families — who were already feeling an income squeeze bore the recession — has taken a heavy toll on individuals and households&apos personal consumption.

第一个主要区别在于导致了经济混乱的因素是房地产崩溃的严重程度及其负债残留。美国家庭在经济衰退之前已经感觉到收入缩水,危机之后,家庭承担的债务负担,对个人和家庭的个人消费产生了不利的影响,

Personal consumption, which accounts for close to 70% of overall GDP, is also expanding off the pace of prior recoveries. As families need to save more — to pay off debts and rebuild diminished retirement savings — they will consume at a lower rate.

个人消费占美国GDP的70%,但它的扩张速度同样低于之前的几次扩张。由于家庭需要增加储蓄来偿还债务以及重新增加被削减的退休储蓄,因此他们就会减少消费。

While the federal government took extraordinary action to shield large banks from the fects of a once-in-three-generations financial crisis, it has done much less to help the average consumer. For example, the Treasury Department has made significant progress in improving its Home Affordable Modification Program (HAMP) -- which uses TARP funding to induce private lenders to write down the value of mortgages -- but there is still no program to reduce the principal owed by those with Fannie Mae or Freddie Mac-backed home loans.

美国政府确实采取了一些临时措施,避免大型银行受到三代美国人才会遇到一次的金融危机的影响,但联邦政府为帮助普通消费者采取的措施却少之又少。例如,美国财政部(Treasury Department)在完善住房可偿付调整计划(Affordable Modification Program,HAMP)方面取得了显著进展,但在减少房利美或房地美背书的住房贷款的本金方面,却没有推出任何计划。住房可偿付调整计划是指,使用 TARP资金,引导私人贷款者减低抵押贷款的账面价值。

There was hope that once Mel Watt, the new director of the FHFA (which is in charge of Fannie and Freddie), would back a program of partial loan forgiveness. But so far, Watt has focused on other priorities and hasn&apost made a move toward principal reduction.

人们一度希望美国联邦住房金融局(FHFA,房利美与房地美的主管部门)新任局长梅尔•瓦特会支持贷款部分免除计划。但到目前为止,瓦特的工作重心依然是其他优先任务,在房贷本金减免方面没有采取任何措施。

Peter Drier, director of the Urban and Environmental Policy Institute at Occidental College, points out that though the real estate market seems to be recovering when you look at nationwide statistics, the underwater mortgage crisis is still current in many communities today. Drier helped craft a report released earlier this month that showed that one in 10 Americans live in one of the 100 cities hardest hit by the foreclosure crisis, places where 22% to 56% of the homeowners are underwater. Helping these people rebuild equity in their homes would pay huge dividends for those cities and the national economy.

美国西方学院(Occidental College)城市与环境政策协会研究所(Urban and Environmental Policy Institute)主任彼得•德利尔指出,从全国数据来看,房地产市场似乎正在复苏,但在许多社区依然存在资不抵贷型房贷危机。德利尔帮助起草了一份报告,已经在本月早些时候发布。报告显示,每十个美国人中,就有一个生活在受到丧失抵押品赎回权危机影响的100个城市之一,这些地区22%至56%的房主都面临着资不抵贷的情况。帮助这些人重建他们在自己房屋中的权益,将给这些城市和整个国家经济带来巨额红利。

Meanwhile, Republicans in Congress have continued to block forts to allow student loan borrowers to rinance at lower rates, prerring to keep the profits the government is making on those loans over finding other ways to pay the government&aposs bills.

与此同时,国会中的共和党人一再阻挠允许助学贷款人以更低的贷款获得再融资的努力。他们更倾向于把政府从贷款中获得的利润留在手里,而不是另外想别的办法来支付政府账单。

It&aposs ironic that a debtor today would have a better shot getting better terms on his loan with a private Wall Street bank than the federal government, but this is the case for many borrowers.

具有讽刺意味的是,今天的债务人可以从华尔街的私人银行获得比联邦政府更优惠的条件,但现实是,许多借款人不得不面对政府的苛刻条件。

Governments have been in the business of debt forgiveness since the beginning of recorded history for the simple reason that it benits society overall. Financial crises like the one we suffered in 2008 come along once in a century, and they require extraordinary, once-in-a-century responses. We figured this out when it came to the big banks, but not for the rest of us.

自有史料记载以来,政府就一直在实行债务减免。原因很简单,因为这样做对整个社会有益。2008年的金融危机百年一遇,因此,这也需要我们拿出百年一遇的特殊应对方法。很可惜,在面对大银行的时候,我们想到了这一点,但对其他普通人却没有。

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

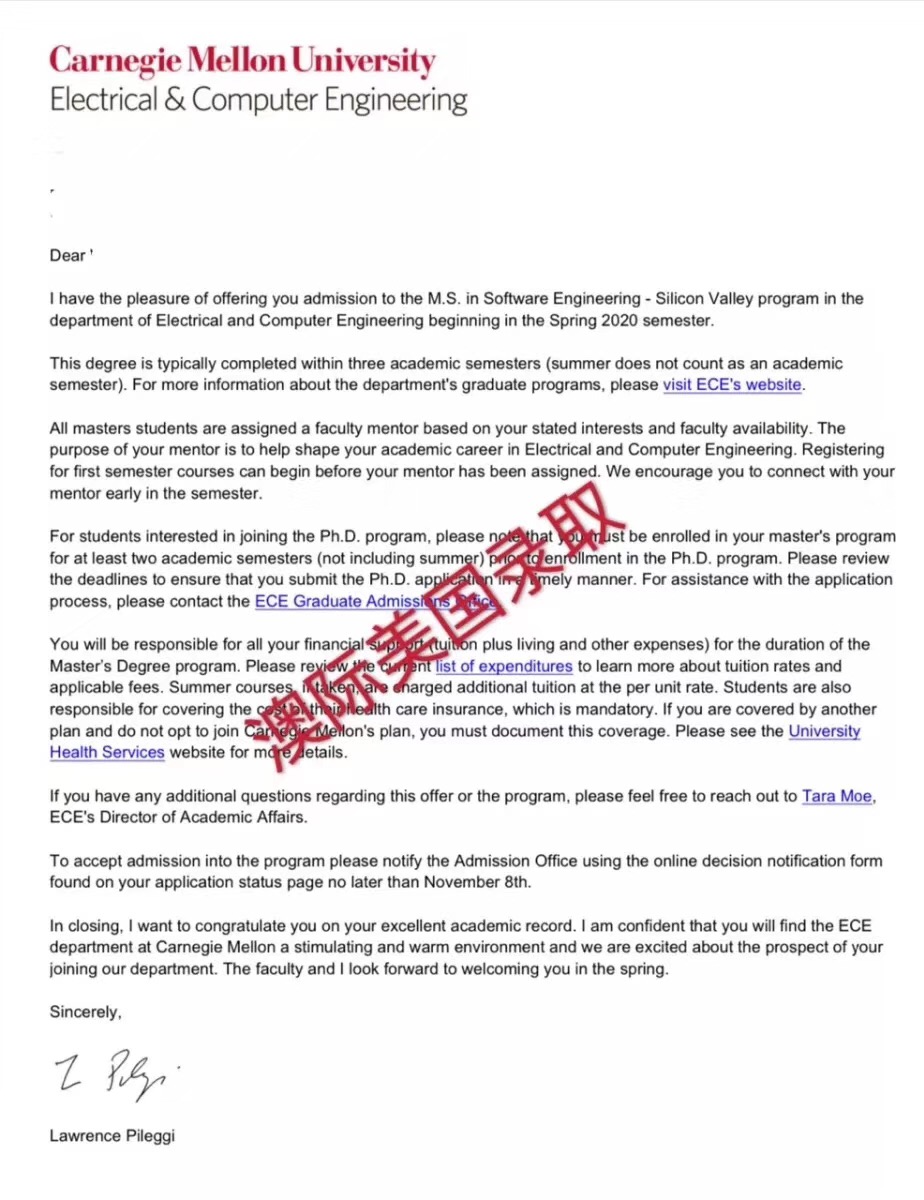

高国强 向我咨询

行业年龄 11年

成功案例 2937人

留学关乎到一个家庭的期望以及一个学生的未来,作为一名留学规划导师,我一直坚信最基本且最重要的品质是认真负责的态度。基于对学生和家长认真负责的原则,结合丰富的申请经验,更有效地帮助学生清晰未来发展方向,顺利进入理想院校。

陈瑶A 向我咨询

行业年龄 15年

成功案例 4612人

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

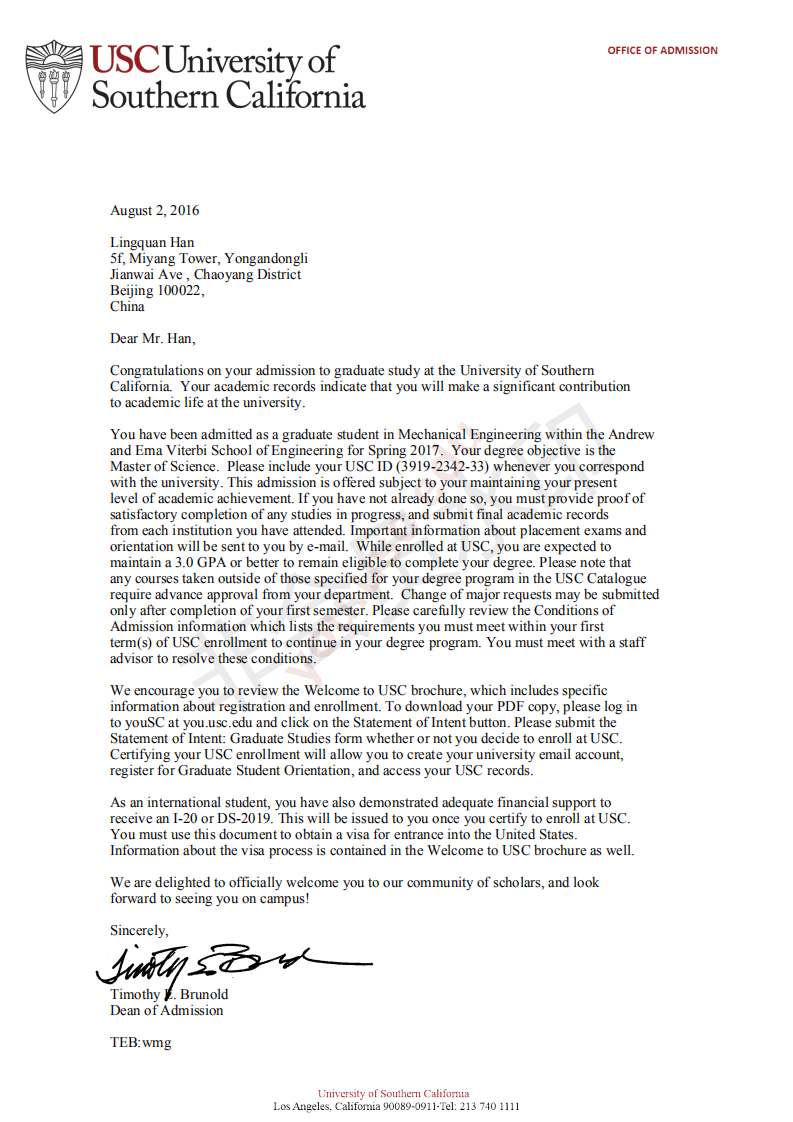

齐亚楠 向我咨询

行业年龄 13年

成功案例 3536人

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 13年

成功案例 3623人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。