孟山都的种子生意为什么能稳赚不赔?.

2017-08-14 254阅读

Why Monsanto always wins

孟山都的种子生意为什么能稳赚不赔?

All those Facebook memes featuring Willy Wonka and The Most Interesting Man in the World warning that genetically modified crops will kill us all have done little to help the anti-GMO cause. Most recently, activists have been fighting to force food companies to affix warning labels to products that contain GMOs. Whether they win or lose won’t matter much, because Monsanto, the world’s largest seed company, is an unstoppable Leviathan, and GMOs are here to stay.

Facebook上所有主打威利•旺卡(电影《查理和巧克力工厂》里好莱坞影星约翰尼•德普饰演的一个角色——译注)和电影《世界上最有趣的人》、警告世人转基因作物会害死大家的“迷因”(meme,一些风格独特的图像或影片,搭配上被社群接受的标语或口号,在病毒式传播下,产生许多变形和二次创作的产物 ——译注)其实都对反转基因运动帮助甚微。最近,不少激进分子努力要让食品公司为含有转基因生物成分的产品贴上警示标签。不过他们成功与否都关系不大,因为全球最大的种子企业孟山都公司(Monsanto)是无人可挡的业界巨头,而正是这家公司一直在致力于推广转基因作物。

The beside-the-pointness of the labeling movement is made starkly plain by a glance at Monsanto’s financials. The company on Wednesday reported a drop in earnings of nearly 6% in the third quarter, but its stock soared by more than 5%. The company also announced it will buy back $10 billion worth of shares over the next two years, and, more to the point, declared that it expects to at least double its profits by 2019, thanks almost entirely to its seeds and genomics businesses.

看看孟山都的业绩表现就会发现,这场贴标签运动其实是多么不值一提。这家公司上周三报告称,它第三财季营收下降了近6%,但股价却飙升超过了5%。它还宣布,今后两年将回购100亿美元的股票。这家公司尤其表示,主要受益于旗下种业和转基因业务,它的盈利到2019年将至少增加一倍。

None of this is particularly surprising, except perhaps to some of the meme-spreaders. And it’s all happening despite more-serious resistance to GMOs across big swaths of the globe.

这些情况其实不足为奇,可能只会让一些“迷因”传播者大跌眼镜。而这个业绩实际上是在全球大范围反对转基因作物的背景下取得的。

Monsanto MON -0.43% makes money almost no matter what. If its corn business sinks, as it has this year, it makes up for some of the losses by selling more soybean seeds (many farmers tend to switch between the crops depending on market conditions). If rivals gain market share, it often makes money from the technology licenses it sells to, for example, DuPont DD -0.18% , its chi competitor (and, as a licensee, one of its biggest customers). When its patents expire, it sells farmers on the newer seed varieties it is constantly pushing through its pipeline. The company is hedged to the hilt: seemingly, any loss is also a potential gain.

不管市场风云如何变幻,孟山都总能赚钱。如果玉米业务像今年一样有所缩减,它就会通过扩大大豆种子(大多数农户都会根据市场情况在这两种作物中挑一种)的销量来弥补这一损失。如果对手的市场份额增加,它就会常常通过把技术许可卖给杜邦公司(DuPont)这样的主要对手(作为技术受让方,也是它最大客户之一)来赚钱。如果它的专利到期了,它又会把它一直在渠道中力推的新种子卖给农户。这家公司能最大限度地对冲风险:任何损失似乎都能带来收益。

That’s especially true when it comes to anti-GMO sentiment and hard-to-crack international markets. Europe is blocking sales of seeds and traits? Open markets in a more-receptive South America, where growth prospects are much bigger anyway. China is closing off its markets out of feigned concern about GMOs? Pour more resources into India.

涉及反转基因作物运动和难以打开的国际市场这两个问题时,尤能看出它的这种本事。欧洲禁止销售种子?那就打开接受度更高的南美市场,反正那儿的增长前景要大得多。中国假装担心转基因作物有害而封锁市场?那就把更多资源转向印度好了。

In the United States, the anti-GMO movement is almost laughably impotent, despite the headlines it manages to regularly snag. GMOs are overwhelmingly dominant here among the major crops, representing more than 90% of corn, soybeans, cotton, sugar beets, and canola. And Monsanto holds huge shares of those markets — about 80% of U.S. corn and more than 90% of U.S. soybeans are grown with seeds containing Monsanto’s patented seed traits (whether sold by Monsanto itself or by licensees). In all, the company holds about 1,700 patents. In 2013, Monsanto racked up sales of $14.9 billion. Of that, $10.3 billion came from seeds and genomic traits.

尽管不时有头条新闻跳出来作梗,但反对转基因作物的运动实际上在美国简直弱小得可笑。美国的主要农作物中转基因作物占了绝对大头,90%以上的玉米、大豆、棉花、甜菜和油菜都是转基因的。在这些市场中孟山都占有极大份额——约80%的美国玉米和90%以上的美国大豆都是用含有孟山都专利的种子(无论是孟山都自己、还是通过它授权经销商销售)种植的。孟山都总共拥有约1700项专利。2013年,这家公司的销售总额高达149亿美元,其中103亿美元来自种子和转基因作物。

GMO crops took up about 1.7 million hectares soon after they were introduced in 1996. Acreage has grown at an average clip of 10 million hectares a year, according to the International Service for the Acquisition of Agri-Biotech Applications, and are now up to 175 million hectares, with no signs of abating. And Monsanto is either leading most of these markets, or is in close competition for them.

转基因作物是1996年面世的,此后种植面积很快就达到170万公顷。据非营利组织国际农业生物技术应用服务组织(International Service for the Acquisition of Agri-biotech Applications)称,转基因作物的种植面积之后以平均每年1千万公顷的速度增加,现在总面积已高达1亿7500万公顷,而且丝毫没有缩减的迹象。在绝大多数这些市场上,孟山都要么遥遥领先,要么和其他对手势均力敌。

The upward trajectory isn’t just luck, and it isn’t just a friendly political climate in the United States (though that has surely helped). For such a big company, Monsanto is nimble, and able to turn on a dime when necessary. For instance, when profits sank during the last recession, the company quickly disinvested in its Roundup herbicide line, which was being quickly replicated by cheaper, generic versions, and shifted more focus to its core seed business, which represents about 70% of the company’s sales. Profits have bounced back in a big way, with net margins at about 30%.

能长期取得这样的增长绝不仅仅是靠运气,也不是光靠美国友好的政治氛围就够了(尽管这一点确实帮助很大)。孟山都尽管规模庞大,却很灵活,同时还能在必要的时候敏捷应变。比如,当最近碰上经济衰退利润下降时,这家公司很快减少了对农达(Roundup)除草剂的投资,迅速用更便宜的一般产品代替了它;同时,它将业务重心更多地放在核心种子业务上,而这一业务约占公司销售的70%。这家公司的利润随之大幅反弹,净利润率高达30%。

Meanwhile, the company is looking far ahead with investments in farm-productivity products such as data analytics. It purchased Climate Corp. last October for $930 million for its to boost its analytics portfolio. Farmers representing about 40 million acres in the United States (about 20% of corn and soybean acreage) are now using the company’s analytic products, about double what the company had earlier forecast.

同时,孟山都还深谋远虑,对数据分析技术这样有助于提高农场生产效率的产品进行投资。去年10月,它斥资9.3亿美元并购了Climate Corp.公司,让自己的多种分析技术产品如虎添翼。目前,美国约4千万英亩(占玉米和大豆种植总面积约20%)的农户使用这家公司的分析类产品,这个规模约为它此前预计规模的两倍。

For several years, Wall Street had been skittish about Monsanto’s prospects, in part because of the loud opposition to GMOs. No longer. Just over the past few quarters, analysts have been ratcheting up their target prices. Wells Fargo did so after the company’s first quarter results were announced. J.P. Morgan followed in April after another successful quarter. On Wednesday, Citigroup’s P.J. Juvekar called Monsanto “our favorite name in ag,” and set a price target of $125 — which was quickly surpassed in the day’s trading. (On Thursday, shares sank slightly, but were still trading just above $125.)

过去几年来,华尔街一直对孟山都的前景有点不以为然,部分原因是因为市场反对转基因作物的呼声甚高。但近几个财季,分析师却开始逐步调高孟山都的股价。这家公司公布第一财季的业绩后,富国银行(Wells Fargo)就这么做了。今年四月,这家公司宣布又成功收获一个财季后,摩根大通(J.P. Morgan)也随之跟进。上周三,花旗集团(Citigroup)的P.J.祖维卡干脆称孟山都为“我们在农业领域最钟情的名字”,同时把它的目标股价设为125美元——而当天交易价格很快就超越这个价位(上周四,孟山都的股价略有回调,但仍然高于每股125美元)。

Such sentiments are also found on the buy side. In May, Larry Robbins of the hedge fund Glenview Capital Management insisted during the Sohn Investment Conference that Monsanto’s shares — then trading at about $110 — were way undervalued. Though he complained about Monsanto “hoarding capital” with its $15.8 billion in “dry powder” (cash), he enthused about the company’s prospects. It enjoys “massive barriers to entry” and “perpetual local monopolies” thanks to farmers basically signing on with Monsanto for life. He noted that while “corn demand will double” over the next 15 or 20 years, “acres won’t,” necessitating far greater yields. “In the real world, we cannot solve world hunger on an organic basis,” Robbins said.

而在买方也同样可以看出这样高涨的情绪。就在五月,格伦维尤资本管理公司(Glenview Capital Management)的拉里•罗宾斯在佐恩投资会议(Sohn Investment Conference)上坚称,孟山都的股价——当时约为110美元——被严重低估了。尽管他对孟山都保持高达158亿美元“干粉”(现金)的“囤积资本”多有不满,但仍非常看好这家公司的前景。这家公司拥有“极高的准入门槛”,同时由于农户基本上都和它签订了终生协议,它还享有“永久性地区垄断”。他还指出,尽管未来15到20年中“玉米需求将翻倍”,但“种植面积却不会同步增加”,从而要求亩产量必须远高于现在的水平。他说:“在现实世界中,我们不可能按有机方式解决世界的饥荒问题。”

Clearly, not everybody agrees with that assessment, but Wall Street sure seems to. And so do farmers.

显然,并不是所有的人都认同这个判断,但华尔街却似乎很是赞同。农户们也是如此。

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

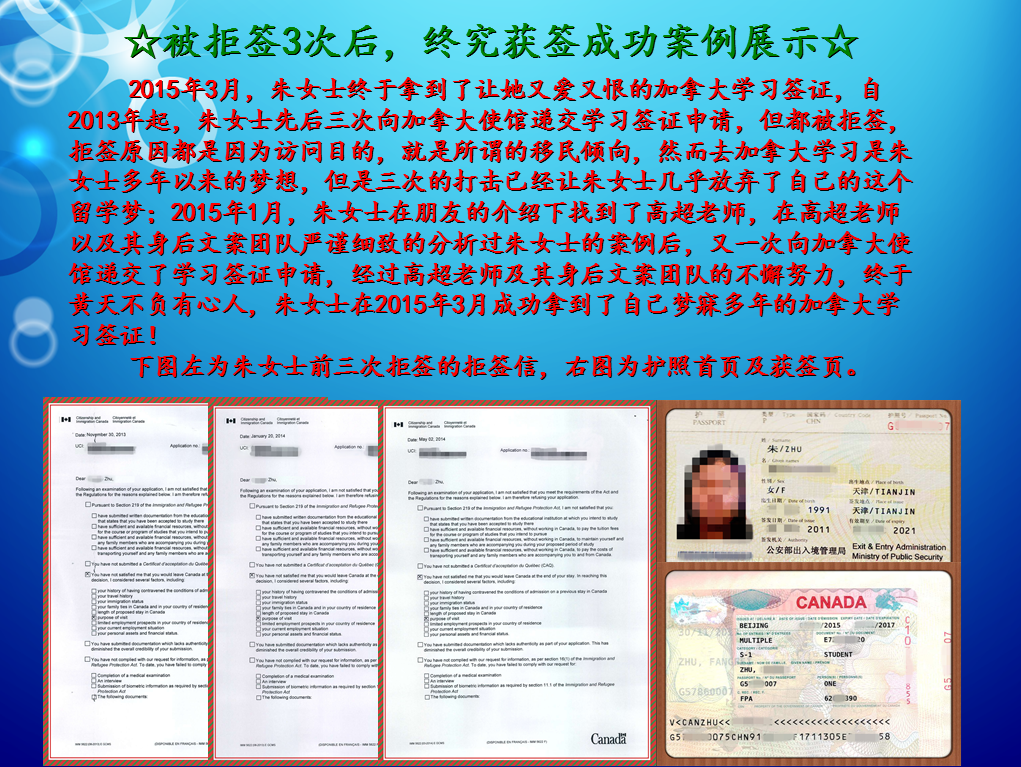

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

高国强 向我咨询

行业年龄 12年

成功案例 3204人

留学关乎到一个家庭的期望以及一个学生的未来,作为一名留学规划导师,我一直坚信最基本且最重要的品质是认真负责的态度。基于对学生和家长认真负责的原则,结合丰富的申请经验,更有效地帮助学生清晰未来发展方向,顺利进入理想院校。

Tara 向我咨询

行业年龄 7年

成功案例 1869人

薛占秋 向我咨询

行业年龄 11年

成功案例 1869人

从业3年来成功协助数百同学拿到英、美、加、澳等各国学习签证,递签成功率90%以上,大大超过同业平均水平。

Cindy 向我咨询

行业年龄 19年

成功案例 5073人

精通各类升学,转学,墨尔本的公立私立初高中,小学,高中升大学的申请流程及入学要求。本科升学研究生,转如入其他学校等服务。