双语新闻美国股市喜中带忧.

2017-08-13 340阅读

美国股市在近几周大幅反弹后再创新高,但这未必就能让人们相信,美国这个世界最大经济体能够彻底躲开席卷全球的经济逆风。下面请看这篇双语新闻。

Much has been made by Wall Street about how the US economy can prosper and stand alone as the eurozone and Japan face intractable problems, China wrestles with slower growth, and the outlook dims for the likes of Russia and Brazil. Against this unsettling backdrop, the argument runs that US equities look good and stand to attract foreign buyers in part because the rising dollar helps boost the value of American holdings for overseas investors.华尔街极力鼓吹美国经济能在欧元区和日本面临棘手问题、中国疲于应对增长放缓以及俄罗斯和巴西等国前景转暗之际保持一枝独秀。在令人不安的大背景下,持这种观点的人认为,美国股市之所以欣欣向荣并能吸引外国买家,部分原因在于美元走强有助于提升海外投资者所持美国资产的价值。

Drill a little deeper into the S&P 500’s performance and one discovers a less than soothing picture. Namely, the market’s rebound has been led by densive sectors, notably utilities, consumer staples and healthcare stocks. Hardly a ringing endorsement of a robust US economy. Indeed, energy, materials and consumer discretionary sectors remain notable laggards during the current quarter, a performance that also typifies their behaviour this year.更深入地分析标普500指数(S&P 500)成分股的表现,你就会发现,情况并不那么让人乐观。换句话说,市场的反弹是由防御性板块拉动的,尤其是公共事业、必需消费品和医疗保健股。这很难算是美国经济表现强劲的有力证明。事实上,能源、原材料和非必需消费品板块本季度的表现仍明显落后于大盘,而且这种表现今年以来简直是家常便饭。

Such a divergence among the largest S&P sectors shows investors are not backing those areas of the market that would signal the US economy is gaining altitude. The outperformance by densive sectors suggests that the message being sent by low long-term Treasury yields has been heard by equity investors.标普500指数主要板块之间出现的这种分化,显示出投资者支持的并非那些标志着美国经济正在走强的市场领域。防御性板块的突出表现说明,股票投资者已经领会到了长期美国国债收益率偏低释放出的信号。

For all the cheering about the current earnings season surpassing expectations, albeit from the usual low bar, the outlook for coming quarters has slipped. While third-quarter earnings have seen companies largely avoid fallout from a stronger dollar and weaker global growth hurting earnings, the downbeat guidance has lt a mark.眼下正值财报季,尽管发布出来的财报情况好于之前的预期(当然预期原本就不高)、令投资者欢欣鼓舞,但未来几个季度的前景已开始变得有些黯淡。三季度企业利润基本没有受到美元走强、全球增长走弱的冲击,但悲观的盈利指引给人们留下了深刻的印象。

Rlecting their poor price performance, energy and materials led the downward profit revisions for the S&P 500 as sliding oil and commodity prices weighed heavily.石油和大宗商品价格下跌对能源和原材料股影响明显,这两个板块的股票是标普500指数成分股中利润预期下调幅度最大的,它们的股价表现也不佳。

Equity bulls extol the boost for consumers’ wallets from cheaper petrol prices. However, the internal dynamics of the broader market suggest investors are still waiting for stronger sales growth that only comes from a sustained recovery in spending.看涨股市的投资者称,石油价格下跌让消费者的钱包鼓了起来。然而,大盘内部各板块的表现反映出,投资者仍在等待销售增长走强,而这只能来自于消费的持续复苏。

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

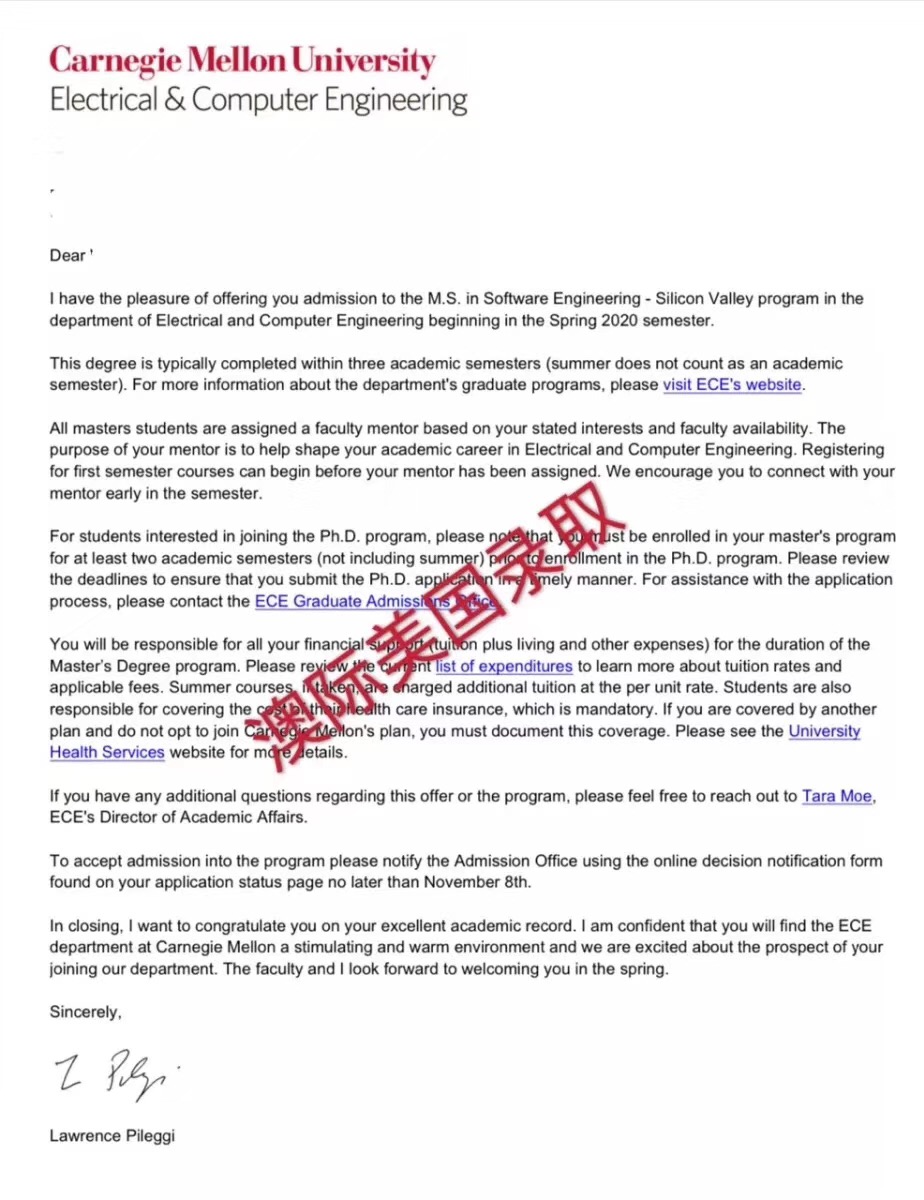

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

齐亚楠 向我咨询

行业年龄 15年

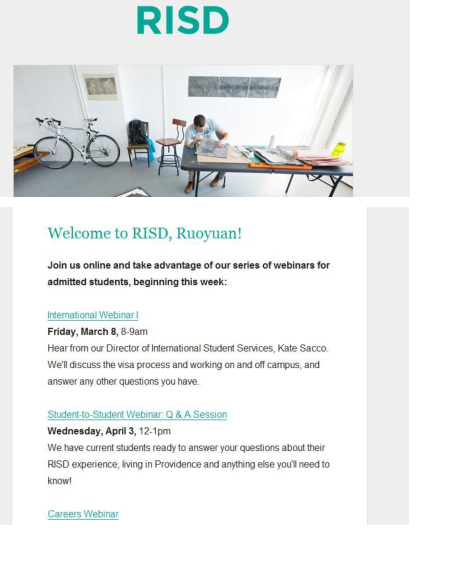

成功案例 4070人

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。

闫丽 向我咨询

行业年龄 19年

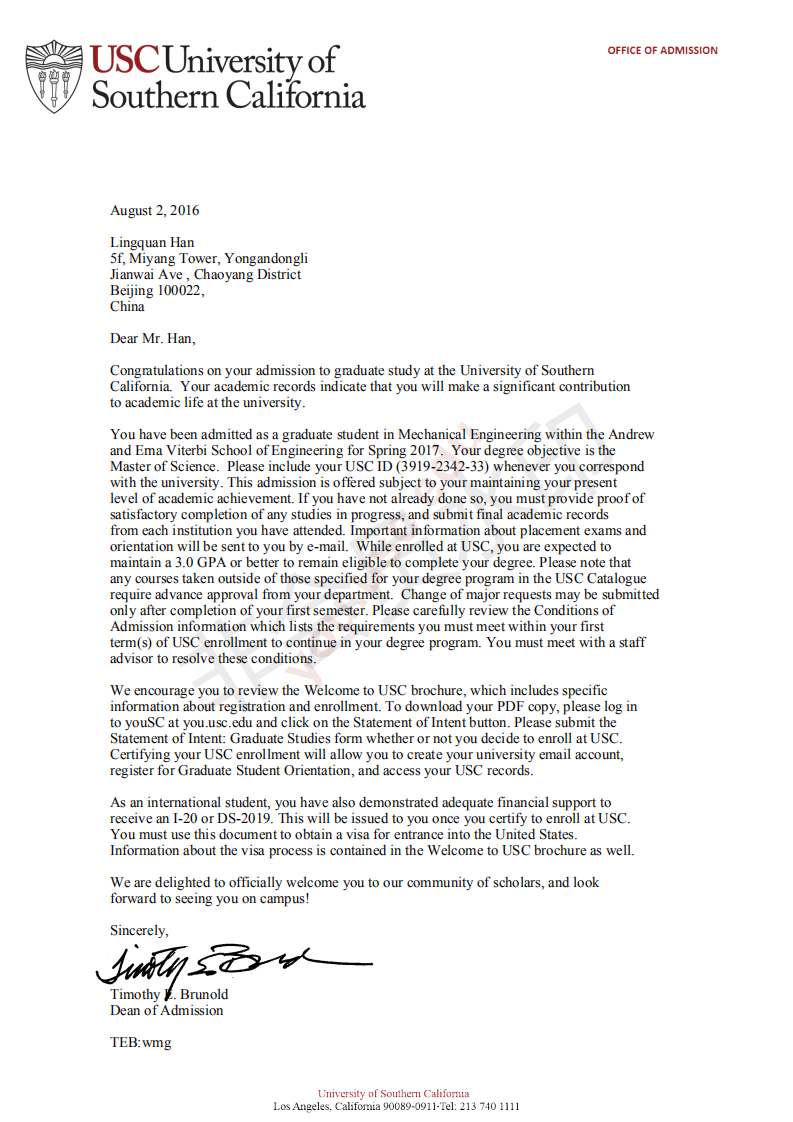

成功案例 6995人

成功办理了2000多名学生,申请到斯坦福大学、约翰霍普金斯、康奈尔等世界前30的名校。