互联网女皇的报告正在警示美国注意中国互联网公司!.

2017-08-13 587阅读

After having been at Kleiner the past two years for “Trends season” as the team calls it, it was amazingly rreshing to read Mary’s Internet Trends report for pure pleasure.

在过去两年中,作为Kleiner公司“Trends Season”团队的一员,能够阅读Mary的“互联网趋势报告”让我神清气爽。

As part of Mary’s team at Kleiner Perkins, I can appreciate the incredibly detailed research, intense thought and 100s of hours of time that goes into creating what has become the industry’s go-to state of the Internet (mobile).On the surface, Mary’s analysis is interesting, but it is her ability to provoke thoughts around future implications of our world that is most powerful.

作为Mary在Kleiner Perkins的团队一员,我能够欣赏到不可思议的详细的研究资料、热情洋溢的想法,和花大量时间研究出来的现状。表面上,Mary的分析仅仅是有趣,实际上,这引起了我们世界未来影响的强有力的思想方面的冲击。

With a fresh set of eyes and the liberty of not reading footnotes for typos, I had the patience to do what “The Queen of the Net” intends all of her readers to do, critically think about her analysis and let their minds wonder freely. As she tells us all, you must take a step back and “dream the dream.”

抛开打印错误,在一双明亮的眼睛帮助下,我和其他网络女王的读者一样,按照她的意思批判的看待她的分析并且自由的思考。正如她告诉我们的那样,你们必须后退一步,并且拥有一个梦想。

While reading Trends, I became fascinated with the slides summarizing the recent US tendency to China’s “playbook” around messaging platforms.

在阅读报告的同时,我对最近美国关于中国关于信息平台的剧本的各方面总结非常入迷。

I began to wonder where else the US internet market might run a Chinese “play,” and what those storylines would imply for global internet brands. I warn, some of the implications are scary and admittedly low probability, but it’s always fun to think about what the future of the global internet could hold. So, let’s play out some of the most interesting scenarios.

我开始好奇,还有哪里的美国互联网市场可能会使用中国的脚本。并且那些情节暗示全球国际名牌。我认为,一些含义非常可怕并且可能性很低。但是考虑未来全球互联网能获得什么总是非常有趣的。所以,让我们展开一些最有意思的剧情。

Playbook A: Lower Marketplace Take Rate – for the most common Chinese playbooks

剧本A:针对中国互联网市场的模型——北美将出现更低的截留比率

Slide 158 shows that China’s e-commerce companies have significantly lower take rates, faster growth rates and larger scale when compared to their US counterparts.

资料显示在和美国同行相比时,中国电商有明显的截留比率(投资者投入100元,截留1元,即为1% Take Rate)、更快的增长速度和更大的手笔。

The lower Chinese take rate extends beyond e-commerce into mobile marketplaces; Didi/Kuadidi (Uber of China) has a take rate of ~0% vs. Uber & Lyft who have take rates of ~10%.

低截留比率方法让中国不断深入并拓展移动市场。滴滴打车/快滴打车截留比率为0%,相比较而言美国的Uber和Lyft截留比率为10%

Most marketplace businesses in the U.S. pitch/expect they can reach ~20% take rate over time, including Uber and Lyft.

但是大多数的美国市场的截留比率会随着时间的过去达到20%,其中包括Uber和Lyft。

Given the intense battle for market-share (competition), limited access to capital (although it doesn’t feel like that today) and proven success in China it is very possible that we see take-rate compression in the US and long-term unit economics that are significantly lower than many companies are predicting.

在进行了激烈的市场占有率竞争后,这种在利润上的受限和在中国已经证明的成功使得我们看到美国市场截留比率的压缩或许将成为一种可能,并且我们能够发现美国采用利润压缩及长效经济的模式通常比很多公司预测的要少得多。

This will have tremendous implications on FCF, which Mary points out is a key to ultimate company valuation (slide 176). The math is simple, if Uber’s take rate is 5% vs. 20% their GMV (what riders pay for a ride), must be 4x as big to have equal net revenue.

但这一切也会对FCF造成极大的影响,就如同Mary指出的,这是最终公司资产评估的关键。这道数学题很简单,如果Uber 的截留比率分别为5%及20%,那么在用户数不变的情况下,前者就要比后者拥有4倍的用户数。

In the extreme case, what if Uber’s take rate was forced to be 0%? Worth noting, this is not outside of the realm of possibility -- western-centric companies OfferUp, Wallapop, VarageSale all have 0% take rate and combine for ~$2B+ of GMV.

在极端条件下,如果Uber的截留比率被迫降到了0%,将会发生什么?不外乎另一种可能,美国重要的同类公司OfferUp, Wallapop和 VarageSale都将被逼至0%的截留比率,并且整合出超过20亿美元的市场份额。

Let’s assume this is true, marketplace take rates trend toward 0%. Could Uber, Postmates, Handy and Zirx still exist? There are certainly other business models that can exist on top of these platforms that could allow them to make profit.

如果这些假设这是真的,市场利润率趋向于0%。Uber, Postmates, Handy 和 Zirx这些公司还能生存吗?他们当然还有其他的商业模式让这些平台能够盈利。

Uber could show ads (they already are) to their users and have ad supported rides. Other marketplaces (mostly content) have this as their primary business model (e.g. Youtube).

Uber能够对他们的顾客播放广告。其他行业其实也把这个作为基础商业模式。(例如Youtube)

Another option is Uber implements a subscription business model where to use the app you have to pay $100 per month (+ pass on cost of ride to drivers).

Uber另一个可选的方案是,采取会员商业模式,对APP的使用进行每月100美元的收费。

Playbook B: Local Market Consolidation (M&A) – As summarized in Slide 157, China’s Internet has seen accelerating consolidation through M&A, the most notable being the recent merger of Didi/Kuaidi.

剧本B:联合当地市场

It seems inevitable that US marketplaces will follow suit overtime as the intense competition is leading to lower take rates, higher customer acquisition costs and excessive cash burn.

似乎不可避免的是,由于竞争的进一步激烈,美国市场也将跟风导致更低的平台截留比率,更高的用户获取成本以及最终过多的资金被消耗。

We are already hearing rumors of this M&A playbook being run in the US

Playbook A & B are closely related. If competition increases (or remains high), take-rates will fall, resulting in a higher likelihood of M&A (which could then decrease competition and lead to a higher take rate).

目前已有风传,收购或联合当地市场的政策正在被执行。其中,上述的剧本A和剧本B是紧密相关的。如果竞争进一步升级的话,截留比率将会继续下降,并且会很可能导致市场兼并行为的产生。

Playbook C: Large U.S. Companies try to Invest in Emerging Chinese Leaders:

剧本C:大型美国公司将尝试对崛起的中国互联网领袖进行投资。

We are seeing the Chinese mega-internet companies aggressively investing in industry leading private US companies. Alibaba has put $100s of millions into Snapchat & Lyft (and Didi/Kuaidi), and invested in Quixey, Ouya, Peel, Kabam and Jet among others.

我们能够看到中国大型互联网公司正在积极向美国领衔的私企进行投资。阿里巴巴已经向Snapchat & Lyft公司投资超过1亿美元,并且还针对Quixey, Ouya, Peel, Kabam and Jet进行了投资。

Tencent has invested $10s of millions into Snapchat and is also an investor in Pocketgems, Whisper, Weebly, Scanadu, Riot Games etc.

腾讯已经给Snapchat公司投资几千万美元,并且它还是Pocketgems, Whisper, Weebly, Scanadu和 Riot Games等公司的投资商。

Baidu invested in Uber’s Series E. Could we see mega-internet companies in the US follow suit?

百度投资Uber的E系列项目。那么未来或许我们能够看到美国互联网公司也这么做吗?

Potential Chinese Playbook D: Cross Border Acquisitions (US tries to Follow):

可能的中国剧本D:跨界融合

The interesting part about playbook C is that the next logical step for Chinese companies is to start aggressively making acquisitions of US based internet brands.

剧本C的有意思的部分是中国公司逻辑上的下一步---开始强力收购美国互联网品牌。

It is unlikely that Tencent or Alibaba will displace Facebook (WA, Insta, Messenger) or Amazon with their core offerings today.

这不像腾讯或者阿里用他们的核心服务挤走Facabook和亚马逊。

However, what would a world look like where Alibaba or Tencent acquired Snapchat (again they are already investors)? The implications of a Chinese company having control over a communication and media platform with ubiquitous scale and engagement in the US would be unique

然后如果阿里和腾讯收购了Snapchat公司世界会变成什么样?中国公司的影响力将以超大的规模掌控美国通信和媒体平台,成为美国市场的寡头。

Playbook E: US restricts Chinese Internet Operations (or acquisitions) in the US:

剧本E:美国限制中国在美国的互联网运营和并购。

The Chinese government has been stifling US internet company penetration for years and the strategy has enabled Chinese Internet companies to flourish

中国政府已经封锁美国互联网公司好几年了,并且这项政策使得中国互联网公司蓬勃发展。

Beyond the cultural challenges, the Chinese government is making it next to impossible for our brands (Facebook, Google, Twitter, LinkedIn) to exist in China.

除了文化挑战,中国政府几乎使得美国品牌不可能在中国生存,如Facebook、谷歌、Twitter、领英。

As China’s threat toward US internet penetration grows, perhaps the US government adopts a similarly restrictive stance (it has not done so today, but Chinese internet companies are not yet a threat to US based companies).

在当中国对美国互联网产业渗透加速的同时,可能美国政府也采用了类似的限制性态度。(可能目前还没采取,是因为中国互联网公司对美国基础公司还不是威胁)

All this said, if DJI is any early indicator (the most innovative and formidable Chinese brand in the US), the US might continue sit back and let a Chinese branded consumer platform dominate our market.

所有一切表明,如果美国政府继续观望,那么很有可能带有中国烙印的消费平台将控制我们的市场。

Potential Chinese Playbook F: China has the first Trillion $ Internet Company, the US follows

可能的中国剧本F:中国拥有了第一个万亿美元的互联网公司,美国紧随其后。

(I am not counting Apple as an internet company, but that is a discussion for a different day): It is likely the first trillion dollar internet company owns both China and the US (2 largest smartphone subscriber bases in world).

如果出现,它很有可能是第一个中美共同拥有的价值万亿美元的互联网公司。(试想一下两个在世界上拥有智能手机用户最多的国家)

Given Chinese government censorship of US internet companies and the US openness toward Chinese internet investments / operations , it would seems as though there is a higher probability that a Chinese company wins in the US as compared to a US company winning in China.

但美国互联网公司要经过中国审查机构审查,而中国互联网公司面对的是美国开放。这看起来很有可能中国互联网公司在美国比美国互联网公司在中国更容易获得成功。

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

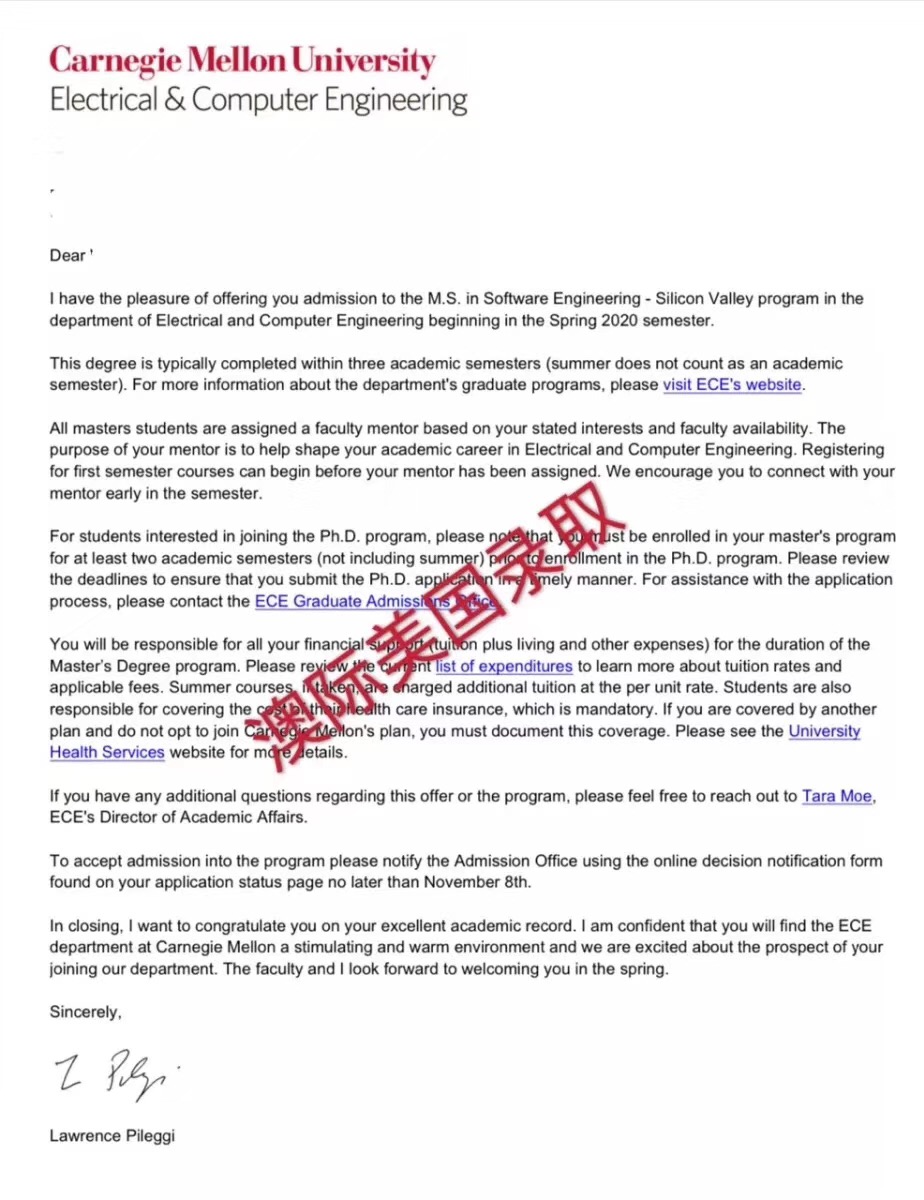

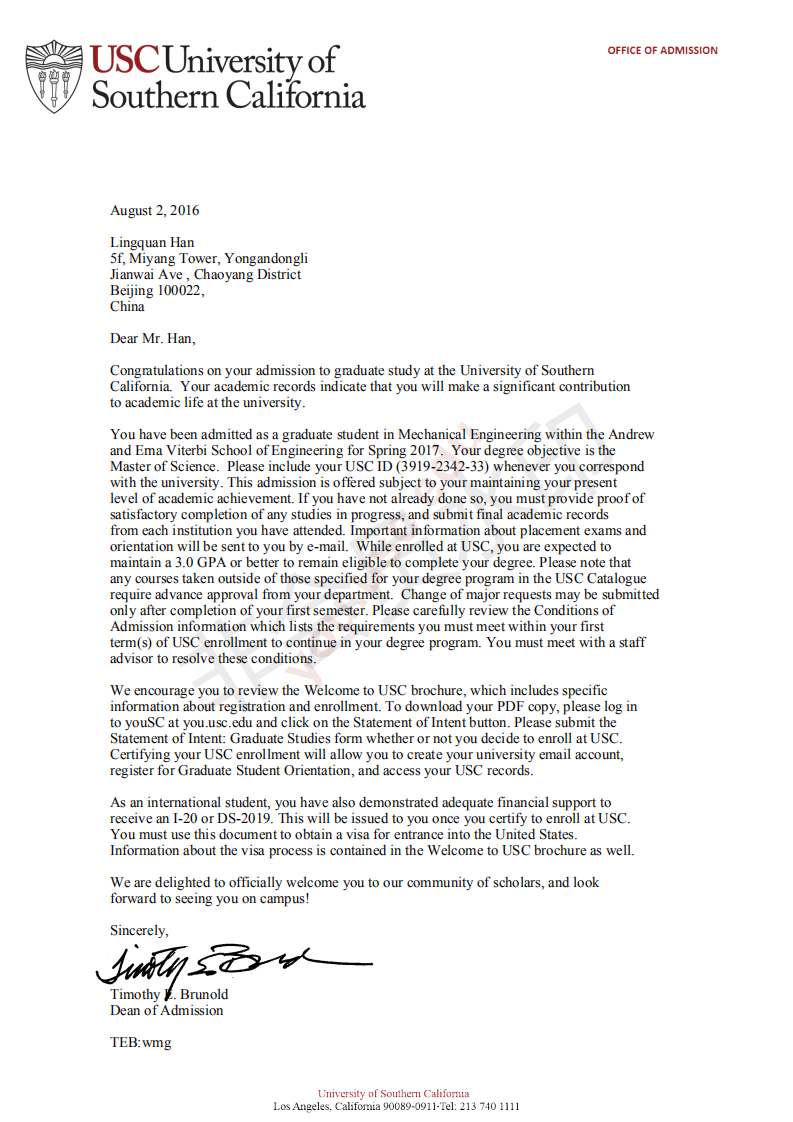

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

齐亚楠 向我咨询

行业年龄 15年

成功案例 4070人

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。

闫丽 向我咨询

行业年龄 19年

成功案例 6995人

成功办理了2000多名学生,申请到斯坦福大学、约翰霍普金斯、康奈尔等世界前30的名校。