雅思写作Task2范文:教育税收与家庭

2017-07-10 309阅读

没有在公立学校上学的孩子的家庭,就不用承担全民教育税收。在这篇雅思范文里,作者陈述了自己的观点,大家可参考一下。认真研读一定的雅思范文及作文模板可以帮助我们检验自己的写作水平,并能很好地吸收和应用优秀范文里的优秀内容。

Families who do not send their children to government-financed schools should not be required to pay taxes that support universal education.

Model Answer 1: (Agree)

Families who do not send their children to government-financed school should not be required to pay taxes that support universal education.

When families send their children to non-public (that is, parochial and private) schools, they must pay tuition and other school expenses. Spending additional money to pay taxes creates an even greater financial hardship for these families. They must make sacrifices, trying to have enough money to pay for school in addition to other bills. For example, my friend Amalia is a single mother with an eight-year-old son, Andrew. Because they survive solely on her income, money is tight. Amalia works at least 10 hours of overtime each week to cover Andrew's school expenses. This gives Amalia and Andrew less time to spend together, and she is always so tired that she is impatient with him when they do have family time. Clearly, this extra expense is an unfair burden for hard-working parents like Amalia.

While some people may consider parochial or private school to be a luxury, for many families it is essential because their community's public schools fail to meet their children's needs. Unfortunately, due to shrinking budgets, many schools lack well-qualified, experienced educators. Children may be taught by someone who is not a certified teacher or who knows little about the subject matter. Some problems are even more serious. For example, the public high school in my old neighborhood/neighbourhood had serious safety problems, due to students bringing guns, drugs, and alcohol to school. After a gang-related shooting occurred at the high school, my parents felt that they had no choice but to enroll me in a parochial school that was known for being very safe.

Unfortunately, even when families prer public schools, sometimes they can't send their children to one. These families are burdened not only for paying expenses at another school, but also by being forced to pay taxes to support a public school that they do not use.

Model Answer 2: (Disagree)

Families who do not send their children to public school should be required to pay taxes that support public education.

Every child in my country is required to attend school and every child is welcome to enroll at his/her local public school. Some families choose to send their children to other schools, and it is their prerogative to do so. However, the public schools are used by the majority of our children and must remain open for everyone. For example, my uncle sent his two children to a private academy for primary school. Then he lost a huge amount of money through some poor investments and he could no longer afford the private school's tuition. The children easily transferred to their local public school and liked it even more than their academy. The public schools supported their family when they had no money to educate their children.

Because the public schools educate so many citizens, everyone in my country-whether a parent or not-should pay taxes to support our educational system. We all benit from the education that students receive in public school. Our future doctors, fire fighters, and teacherspeople whom we rely on everyday-are educated in local public schools. When a person is in trouble, it's reassuring to know that those who will help you-such as fire fighters-know what they're doing because they received good training in school and later. Providing an excellent education in the public school system is vital to the strength of our community and our country.

Our government must offer the best education available, but it can only do so with the financial assistance of all its citizens. Therore, everyone-including families who do not send their children to public school-should support public education by paying taxes.

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

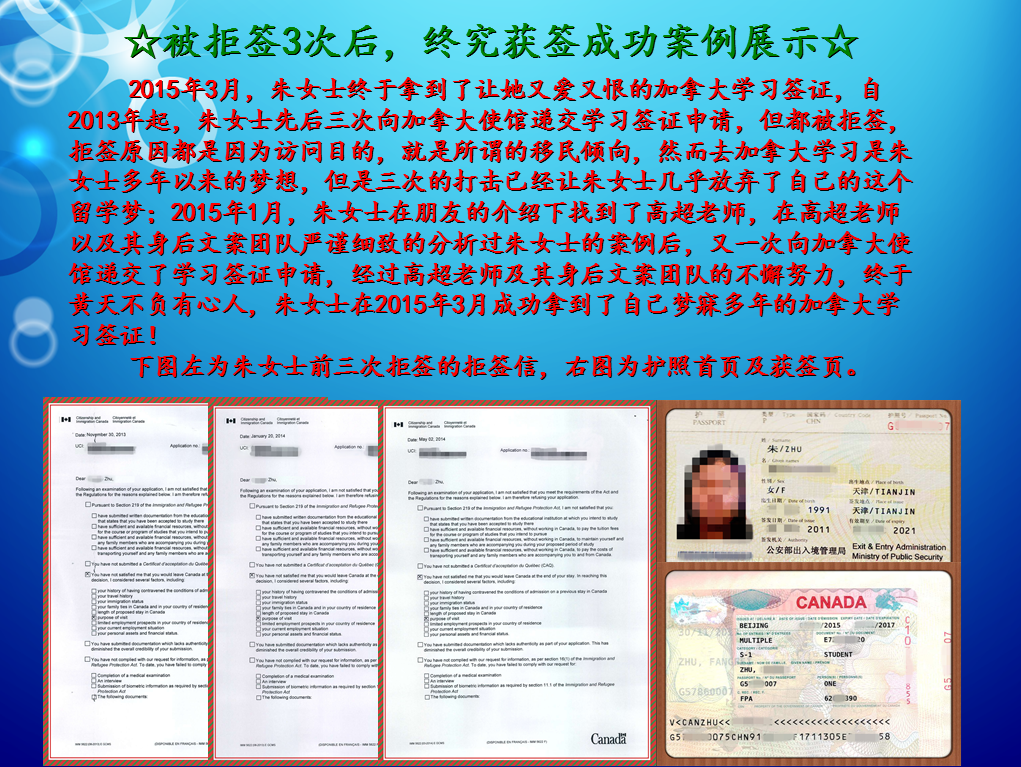

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

Tara 向我咨询

行业年龄 8年

成功案例 2136人

Cindy 向我咨询

行业年龄 20年

成功案例 5340人

精通各类升学,转学,墨尔本的公立私立初高中,小学,高中升大学的申请流程及入学要求。本科升学研究生,转如入其他学校等服务。

薛占秋 向我咨询

行业年龄 12年

成功案例 1869人

从业3年来成功协助数百同学拿到英、美、加、澳等各国学习签证,递签成功率90%以上,大大超过同业平均水平。

Amy GUO 向我咨询

行业年龄 18年

成功案例 4806人

熟悉澳洲教育体系,精通各类学校申请程序和移民局条例,擅长低龄中学公立私立学校,预科,本科,研究生申请