美国金融数学/数学金融/金融工程专业

2017-06-07 1048阅读

美国金融数学/数学金融/金融工程专业就业前景如何,平时都学习什么课程呢?相信这是很多想申请美国金融数学/数学金融/金融工程研究生的学生想了解的内容。下面就给大家详细解析这个专业。

金融工程Finance Enginerring:Learning methods for monitoring financial markets and evaluating financial assets and organi

金融工程Finance Enginerring:Learning methods for monitoring financial markets and evaluating financial assets and organization是研究如何监督,管理,评估金融市场,金融工具以及金融机构的一门学科。

如果你缺乏一个直观的认识,那么举几个金融工程/数学金融里面的题目框架出来。

Theories and Practice of Risk Management研究风险管理(risk management)以及模拟证券投资(simulate equity investment)的基本理论。

Evaluation and Measurement of Organizational Performance依据公司的财务金融数据(股价,公司债券价格等等)研究公司(corporate) 和证券市场( security market) 的关系研究非营利机构的金融管理。

Methodology of Evaluation评估的方法,理论,发展。

计量金融(Quantitative Finance)专为金融市场而设的一门应用数学。计量金融本义上与金融经济学的范畴有密切的关系,然而前者所涉及的领域比较狭隘,理念也比后者抽象。一般而言,若金融经济学家研究一所企业当前股价的结构性原因,数学家(或计量金融学家)所做的便是利用当前股价作参考,利用或然率微积分去计算并取得相关衍生工具的公平价格(应值价格)。

毕业出来能做什么样的工作careers排除人脉,门道,运气等等因素,根据国际金融工程研究会报:

QUOTE:

Financial engineers use the skills they acquire during their degree programs toward a broad selection of careers in finance, including the trading of securities, financial modeling, sales, risk management and portfolio management. We believe that the skill sets acquired in a financial mathematics masters program are sufficiently broad to prepare students for many interesting fields. Moreover as it is increasingly recognized in financial firms that computational and mathematical skills are critical to the success of all organizations, the market for students with financial mathematics degrees continues to broaden.

In the 2002 Survey, 38% of students stated that they want a career in some sort of job related to derivatives pricing, while 21% said risk management and 18% said trading derivative instruments (14% of students did not respond).

It's vey likely a student in FE becomes an expert at evaluation such as a "certified accountant (CPA)", a "financial analyst (CFA and CMA)", a "valuation actuary", an "estate surveyor", or managing positions at companies, governments, educational organizations, and NPOs including religious corporations.

学这些专业需要怎样的背景background

并非只有金融,数学,经济,统计,经济计量的的人才能申请这个专业的硕士和博士。

从伯克利大学的统计数据上看,除了以上专业,背景是计算机,物理,化学的人也可以申请并被录取。

但有几个对于申请的有利条件

1,数学理论和应用数学/工程学(pure and applied mathematics and engineering)

2,经济,金融基本知识

3,计算机能力

4,对金融市场,工具,机构强烈的兴趣

有哪些学校提供这些专业

这个专业在美国最多;英国,澳大利亚也有;欧洲不是很多。

Ball State University

BS Financial Mathematics

Baruch College

Masters of Science in Applied Mathematics for Finance

Bogazici University

MS Financial Engineering

Boston University

MA Mathatical Finance

Polytechnic University

MS Financial Engineering

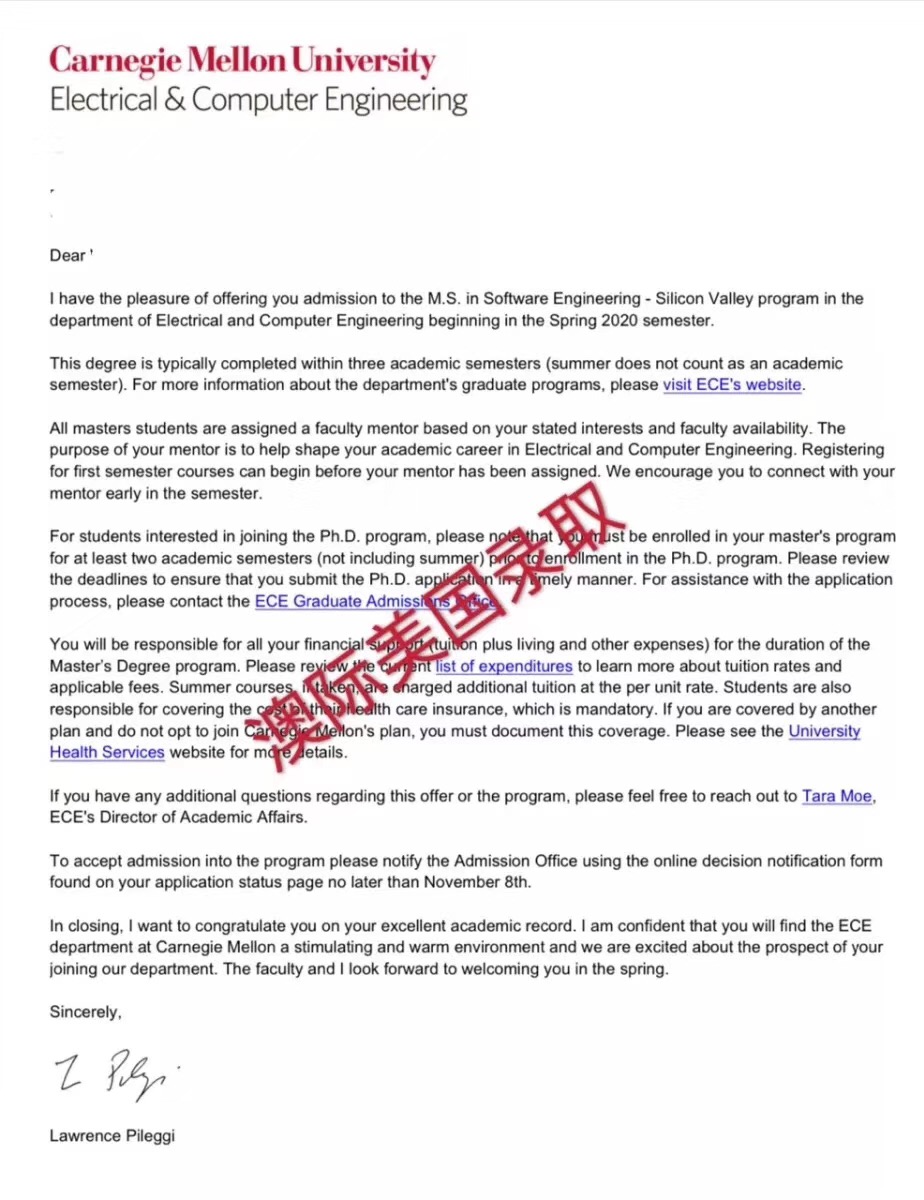

Carnegie Mellon University

MS Computational Finance

Carnegie Mellon University

PhD Mathematical Finance

Cass Business School

MS Mathematical Trading and Finance and

MS in Finance, Economics and Econometrics

City University of Hong Kong

MS Financial Engineering

Claremont Graduate University

MS Financial Engineering

Columbia University

MS Financial Engineering

MA, Mathematics, with specialization in the Mathematics of Finance

MS, Industrial Engineering and Operations Research

Financial Engineering courses available

Cornell University

MBA Financial Engineering

Cornell University

M. Eng in Operations Research & Industrial Eng.

DePaul University

MS Finance/Risk Management/Financial Engineering

Dublin City University - Ireland

MS Investment and Treasury

MSc Financial & Industrial Mathematics

Erasmus University Rotterdam

Master in Quantitative Finance

FAME: International Center for Financial Asset Management and Engineering - Geneva

Executive Education Program, including courses in Alternative Investments and Financial Engineering.

Florida State University

MS & PhD Financial Mathematics

George Washington University

MS, Finance

Georgia Institute of Technology

MS Quantitative and Computational Finance

Georgia State University

Mathematical Risk Management

Glasgow Caleonian University

BS Financial Mathematics

HEC, Montreal

MS Financial Engineering

Illinois Institute of Technology

MS Finance

MS Financial Markets

Imperial College of Science, Technology and Medicine

MSC Mathematics and Finance

James Madison University

BS Quantitative Finance

Johns Hopkins University Graduate School of Business

MS Finance

The Karol Adamiecki Academy of Engineering

MS Financial Engineering and Banking

Kent State University

MS Financial Engineering

Lavel University

MS Financial Engineering

London Business School

Masters in Finance

Massachusetts Institute of Technology

MBA with Financial Engineering Track

Multimedia University, Malaysia

Bachelor of Financial Engineering

Nanyang Technological University

MS Financial Engineering

National University of Singapore

BS and MS Financial Engineering

New York University

MS Statistics and Operational Research, Financial Engineering Specialization

New York University, Courant Institute of Mathematical Sciences

MS Mathematics in Finance

North Carolina State University

MS, Financial Mathematics

Northwestern University

MS, Industrial Engineering and Management Sciences

Financial Engineering Concentration available

Oklahoma State University

MS Quantitative Financial Economics

Princeton University

MSE, Ph.D Operations Research and Financial Engineering

Purdue University

MS Computational Finance

Rutgers Business School

Master of Quantitative Finance

MS Quantitative Finance

Rutgers University (New Brunswick/Piscataway campus)

MS in Mathematical Finance

Stanford University

MS, Financial Mathematics

MS, Management Science & Engineering

Stevens Institute of Technology

Graduate Certificate in Financial Engineering

MS, Financial Engineering

State University of New York at Buffalo

MS, Finance

University of Alabama

MA in Banking and Finance

University of California at Berkeley

MS Financial Engineering

Certificate in Financial Engineering, Executive Education

University of Chicago

MS Financial Mathematics

University of Connecticut

MS Applied Financial Mathematics

University of Dayton

Masters of Financial Mathematics

University of Edinburgh

in partnership with Heriot Watt University

MS Financial Mathematics

University of Florida

Warrington College of Business Administration

MS, Finance

University of Hong Kong

Masters of Finance - Financial Engineering and Risk Management Tracks

University of Illinois at Urbana-Champaign

College of Business

MS, Finance

University of Karlsruhe

MSc, Financial Engineering

University of London

Birbeck College

M.Sc. in Financial Engineering

University of Michigan

Financial Engineering Program

University of Manchester

Manchester Business School

M.Sc. Quantitative Finance

University of North Carolina, Charlotte

M.S. Mathematical Finance

University of Oxford

Diploma in Mathematical Finance

University of Pretoria

MS Mathematics of Finance

University of Reading

ISMA Centre, the Business School for Financial Markets

MS Financial Engineering and Quantitative Analysis

University of Rochester

Simon School of Business Administration

MS, Finance

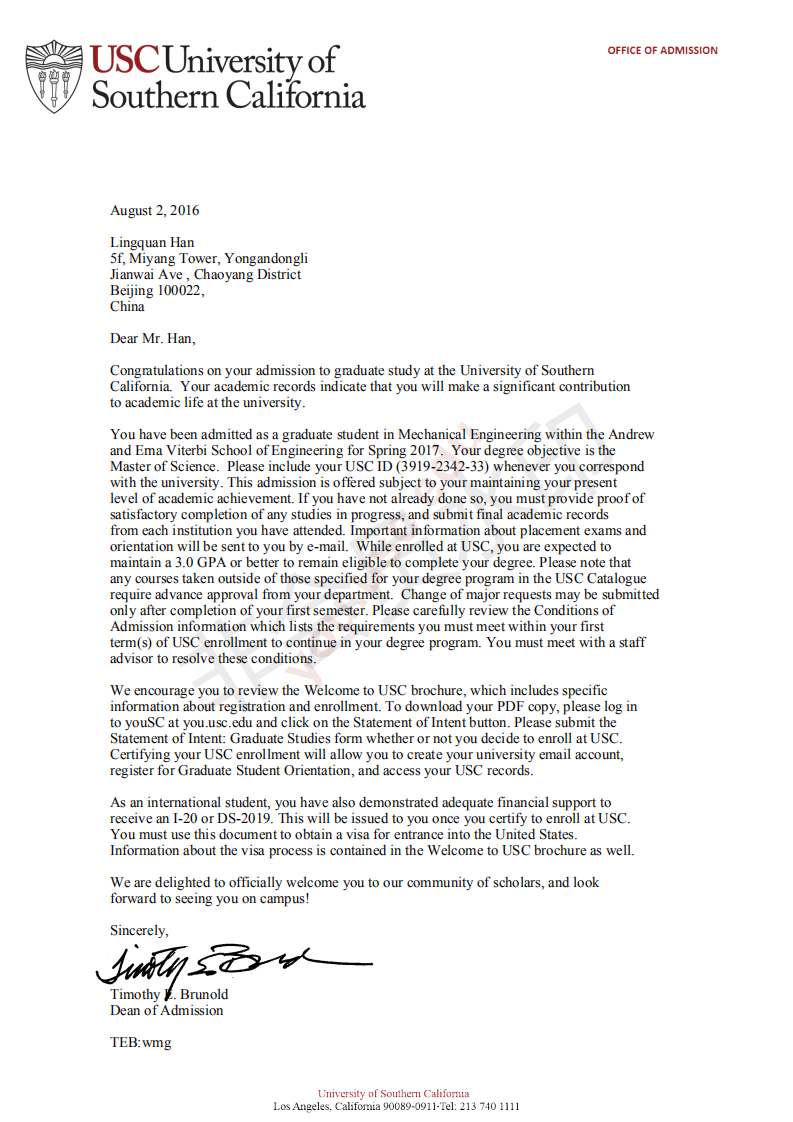

University of Southern California

Professional MS in Mathematical Finance

University of St. Gallen

Master Quantitative Economics and Finance

University of Technology, Sydney

Master of Quantitative Finance

University of Torino, Italy

Masters in Quantitative Finance

University of Toronto

Master of Mathematical Finance

University of Tulsa

MS in Finance / Risk Management

University of Twente, the Netherlands

Masters in Financial Engineering

University Of Valencia, Spain

PhD, Quantitative Finance

University of Warwick

MS Financial Mathematics

University of Waterloo

Mathematical Finance

University of the Witwatersrand-Johannesburg

MCom Finance

Virginia Commonwealth University

Bachelor of Science in Financial Technology

Vrije Universteit Amsterdam, Universiteit Utrecht & Universiteit van Amsterdam

MSc in Stochastics and Financial Mathematics

York University

MS Financial Engineering

如何在学校之间做出选择

1,课程设置:

课程是否全面,是否涵盖了数学,计算机,金融,是否可以为你以后的就业,提供一个坚实的学术基础。如果你本身金融知识薄弱,可以重点看那些通过选课,增加金融理论和应用课程学习的学校。

可能会有的课很多很多,比如:

INTRODUCTION TO FINANCIAL ENGINEERING:

FINANCIAL ENGINEERING,

FINANCIAL ECONOMICS,

MANAGEMENT SCIENCE,

NONPROFIT AND GOVERNMENTAL ACCOUNTING,

CORPORATE AND MARKET SIMULATION,

COUNTRY RISK ANALYSIS,

PROJECT EVALUATION,

BUSINESS ANALYSIS AND VALUATION,

POPULATION DYNAMICS,

MICRO ECONOMY

QUANTATIVE ECONOMIC ANALYSIS

COMPLEXITY AND GAME THEORY,

EVALUATION AND ASSESSMENT OF EDUCATION,

MODERN MATHEMATICS,

MATHEMATICAL PHENOMENA,

NUMERICAL ANALYSIS,

MATHEMATICS FOR INFORMATICS

MATHEMATICAL MODELS

MULTI-VARIABLE STATISTICAL ANALYSIS,

INTRODUCTION TO TIME-SERIES ANALYSIS,

STATISTICAL ANALYSIS,

DATABASE ARCHITECTURE

1,课程设置是否符合专业需要和你的需要

2,理论和实践的时间安排

课程是否包括了理论和实践(真实案例)两部分,并有机结合在一起?

3,院系实力

排名如何?是否有很有实力的教授讲师。今年是否有高质量的论文/学术成果

4,资源和配套设施

网络资源,图书馆,软件,数据库等等

5,实习机会

学校是否提供实习计划,是否有知名公司来该校应聘

6,校友会

一个强有力的校友会,会拓展你的视野和思路,也给你很多信息和机会。

通过上面对美国金融数学/数学金融/金融工程信息的解读,相信对于很多计划申请美国金融数学/数学金融/金融工程的学生可以参考上面的信息来提前做好申请美国研究生的准备和规划。

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

高国强 向我咨询

行业年龄 13年

成功案例 3471人

留学关乎到一个家庭的期望以及一个学生的未来,作为一名留学规划导师,我一直坚信最基本且最重要的品质是认真负责的态度。基于对学生和家长认真负责的原则,结合丰富的申请经验,更有效地帮助学生清晰未来发展方向,顺利进入理想院校。

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

齐亚楠 向我咨询

行业年龄 15年

成功案例 4070人

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。