美国留学California CPA 考试申请流程

2016-05-19 1220阅读

California CPA Exam Requirements exam fees

Initial Application Fee:$50

Audit:$193.45

Financial:$193.45

Regulation:$173.60

Business:$173.60

Total:$784.10

Special Fees: $25 re-examination application fee regardless of the number of parts requested.

Application Process

1、Review exam requirements

A Bachelor's degree from a regionally or nationally accredited college or university with 24 semester units of Accounting and 24 semester units in business-related subjects. Courses in excess of the 24 semester units in Accounting may apply to the 24 semester units in general business.

2、Submit your exam application, enroll in Becker

If you meet the educational requirements, create a personal client account with the California Board of Accountancy at www.dca.ca.gov/cba The application fee will be $50.Your name on the application should exactly match your name on your primary form of identification, which is usually your driver's license. At this time you should also begin planning your study approach by making inquiries into CPA reviews available in your area. The Becker CPA Review offers classes live or online to accommodate the needs of all candidates.

3、Request and forward your transcripts

Contact any educational institutions attended and request that transcripts be forwarded to the California Board of Accountancy for their evaluation. If you do not expect any problems in processing your application it is best to make plans to start your review at this time. The Becker CPA Review will significantly increase your chances of passing the exam.

4、Pay your exam fees

After receiving the required information, the State Board will issue your Authorization to Test (ATT) to the National Association of State Boards of Accountancy (NASBA). You will receive a payment coupon for exam fees totaling $734.10, which must be paid in advance. which must be paid in advance. Once fees are paid, you will receive a Notice to Schedule (NTS) which is good for nine months; however, since every third is non-testing, the NTS covers six testing months.

5、Schedule your exam

Your NTS allows you to start scheduling your exams. You can sit for the exam parts in any sequence so you can plan your reviews to coincide with your exam scheduling. The most efficient approach is to sit for two parts in each exam window; however, exam fees paid for parts not taken are not refundable. Exam times are scheduled with Prometric and can be set up online at www.prometric.com/cpa. You can take the exam at one of the many sites in California, or any other Prometric location that is convenient to you.

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

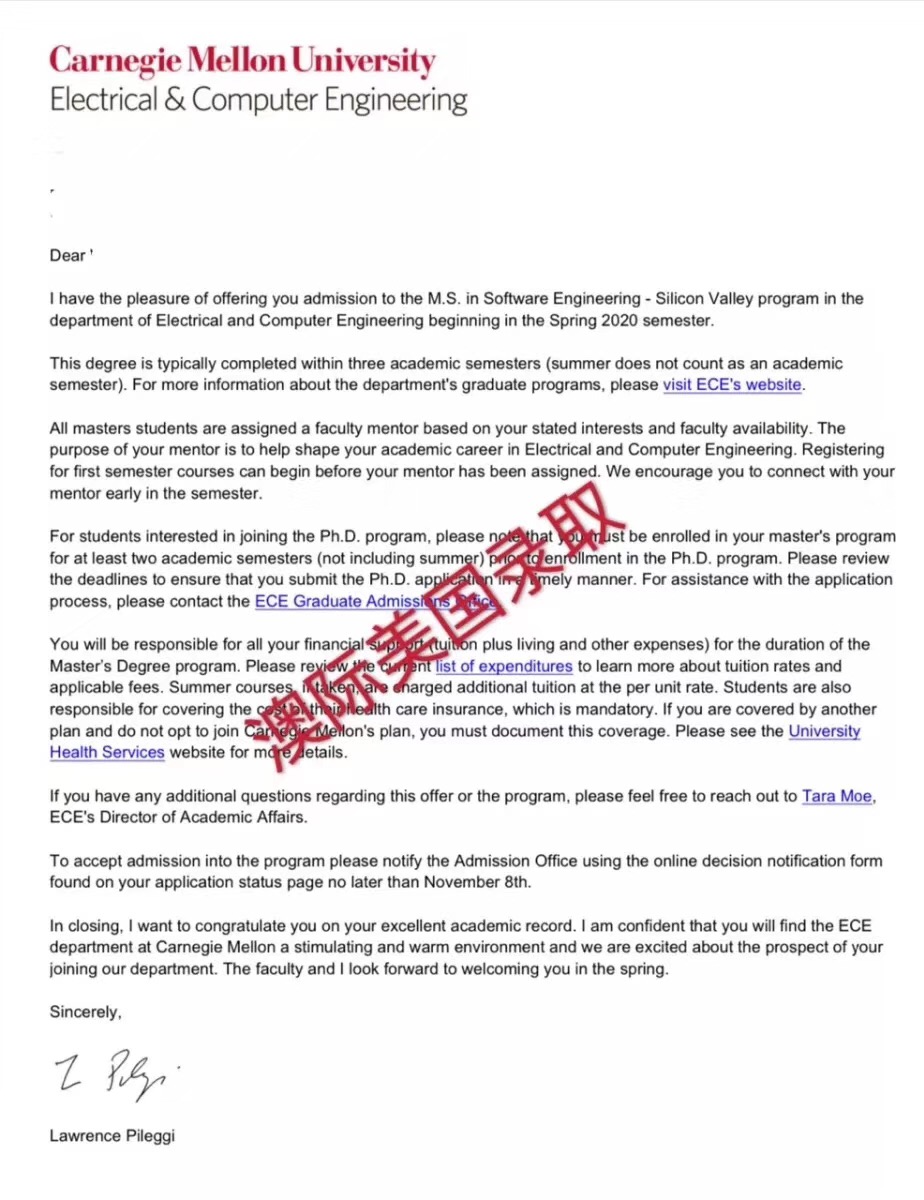

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

齐亚楠 向我咨询

行业年龄 15年

成功案例 4070人

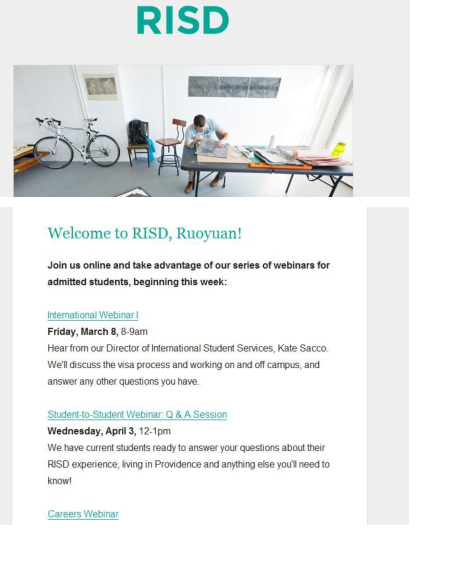

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。