California CPA Exam Requirements

2016-04-19 919阅读

1. Becoming a CPA:

The CPA license is issued at the state or territory (jurisdiction) level. To become a licensed CPA, you must be declared eligible for the examination, and subsequently licensed, by the board of accountancy in one of the 54 U.S. jurisdictions. An individual becomes eligible for the exam by meeting specific requirements as determined by the board of accountancy for the jurisdiction for which they are applying. This website summarizes these requirements for each jurisdiction and provides resources to help you manage the CPA Examination application process.

2. California CPA Exam Requirements

1)Requirements

Education Requirements:

150 Semester Hours Required to Sit for the Exam? No

Minimum Degree Required:

Baccalaureate

Additional Educational Requirements:

24 semester units (or 36 quarter) in accounting (educational requirements vary, contact State Board for specific details) and 24 semester units (or 36 quarter) in business-related courses (educational requirements vary, contact State Board for details)

Note: The requirements shown relate specifically to "applying for" and "taking" the exam. Additional requirements may be in effect relating to "certification" and "licensing", Please contact the appropriate state board for "certification" and "licensing" requirements. As of January 1, 2014 150 hours are required for licensure

2)Residency Requirements

U.S. Citizenship Required: No

Applicant must be a resident, employee, OR have office in the state? No

3)Age Requirements

Age Minimum: None

留学咨询

更多出国留学最新动态,敬请关注澳际教育手机端网站,并可拨打咨询热线:400-601-0022

留学热搜

相关推荐

- 专家推荐

- 成功案例

- 博文推荐

Copyright 2000 - 2020 北京澳际教育咨询有限公司

www.aoji.cn All Rights Reserved | 京ICP证050284号

总部地址:北京市东城区 灯市口大街33号 国中商业大厦2-3层

陈瑶A 向我咨询

行业年龄 17年

成功案例 5146人

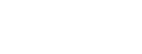

拥有大量高端成功案例。为美国哈佛大学、宾夕法尼亚大学等世界一流名校输送大批优秀人才。

齐亚楠 向我咨询

行业年龄 15年

成功案例 4070人

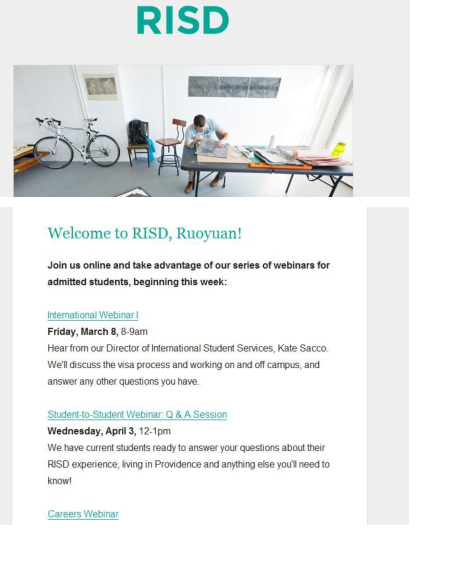

商科案例有哥伦比亚大学等,工科案例有麻省理工大学等,艺术案例有罗德岛大学等。

李君君 向我咨询

行业年龄 15年

成功案例 4157人

成功案例涉及美国排名前60的院校,专业涵盖商科(金融,会计,管理),工科(生物工程,化学工程,计算机科学,电气工程)等热门领域。